Want to send money internationally with your smartphone? Here are the best international money transfer apps to choose from!

As the fintech world continues to rapidly evolve, financial services companies aim to stay relevant and both retain and attract new customers through cutting edge, user-friendly mobile technology. Though Western Union dominates international money transfer, even in the mobile app category, other companies have set their eye on the United States and more remittance apps have begun to appear in the App store. FXcompared has downloaded fifteen of the most commonly used mobile transfer apps and given them a test drive.

How to choose the best money transfer app for you, check the mobile app reviews below:

Other Mobile App Reviews

- Ria Mobile App Review

- Transfast Mobile App Review

- Viamericas Mobile App Review

- Small World Money Mobile App Review

- Xoom Mobile App Review

- World First Mobile App Review

- Western Union Mobile App Review

- Skrill Mobile App Review

- Remitly Mobile App Review

- Transferwise Mobile App Review

- OFX Mobile App Review

Pangea

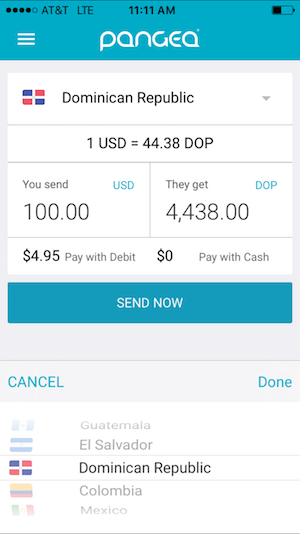

Focused on money transfers to Latin America, Chicago-based startup, Pangea has one of the highest repeat user percentages in the money transfer space, with 65% of its users returning for a second transfer.

App Overview

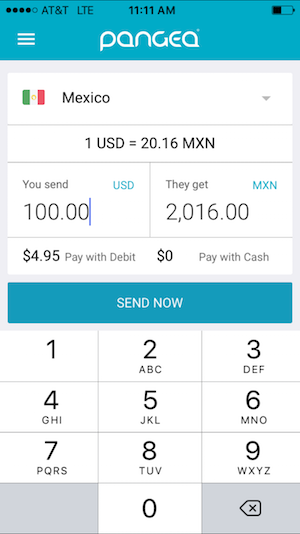

Pangea's mobile app is designed for users to send money home, specifically to Mexico, Guatemala, El Salvador, Dominican Republic and Colombia. If sending money via a bank transfer, users can send up to $2,999 a day via the Pangea app. If Pangea users are sending cash pick up, available at over 14,000 locations, the daily limit is lower, maxing at $999. There is a monthly cap for each user, with a maximum of $6,000/month to be sent via debit card, and $2,000 via cash pick up. Some specific locations, specifically in Mexico, have a lower maximum amount that $999, so it's a good idea to investigate before sending money.

App Specifics

Unique Features

- Registration is free

- Transfers with a debit card have a fixed fee of $4.95

- Over 14,000 available pick-up locations

- Calculator automatically updates exchange rate

Ideal Users

Pangea is the ideal mobile money transfer app for those regularly sending money home to loved ones in Latin America via debit card. In addition to the app's user-friendly interface, the fixed $4.95 rate for debit card users is one of the most competitive fees on the market.

OFX - USForex

Founded in 1998, Australia based OFX offers a variety of foreign exchange services to its clients. Its mobile app reflects this, as it is one of the most expansive apps, offering a variety of tools for users to learn more about foreign exchange.

App Overview

OFX's US mobile app - currently categorized under USForex, is an app designed for users who regularly transfer personal funds, such as those who travel frequently for business or who reside in two different countries.

App Specifics

Users must register with OFX before they can transfer money via the OFX mobile app. By transferring via the mobile transfer app - users have access to over 45 different currencies and 24/7 customer service. Unlike remittance focused apps, you cannot remotely pay phone bills or utilities with the OFX app. The app does provide various helpful tools for those leading a lifestyle that requires frequent currency exchange, such as a currency conversion tool.

Unique Features of the App

- Quick in-app international payments

- Payment tracker

- Global Customer Support 24/7

- Ability to rebook previous money transfers

- Check real time foreign exchange rates

- Read and compare historical currency charts

- Access currency commentary from OFX brokers and stay up-to-date with the FX markets

- The app can monitor specific currencies for you, with personalized currency alerts

Ideal Users

The OFX mobile app is ideal for users who travel internationally frequently, or perhaps own homes in foreign countries. OFX provides access to over 45 different currencies, making it a great app for people who frequent destinations outside of Europe and North America. Because of its rebook feature, those paying mortgages or staff abroad may also find the app convenient.

Learn More

Looking to learn more about international money transfer? You can find more information about sending money abroad throughout the FXcompared website. Check out our review pages, country guides, personal guides and our volatility and audit tools now. You can also check back at this article periodically, as we will continue to regularly update this page with new mobile app reviews.