OFX in New Zealand provides secure and speedy international money transfers to over 300,000 people in 55 currencies at better-than-bank rates.

FXcompared may earn fees from this listing. Learn more

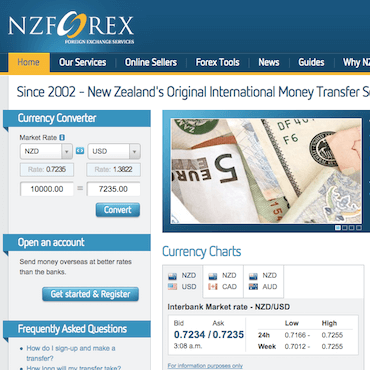

NZForex Limited is a foreign exchange services firm and part of the OzForex Group based in Australia. It provides services for international currency transfers, automated payment plans, and futures contracts with competitive exchange rates and low fees. NZForex offers a blend of cutting-edge technology and customer service available 24/7. NZForex is regulated by the New Zealand Financial Service Providers Register (NZ FSPR).

NZForex provides money transfer services that allow customers to choose the timing and currency rate that suits their foreign exchange needs. Products include spot transactions that are executed immediately, with NZForex finding the best foreign exchange rates available on the forex markets. Forward contracts are available to NZForex customers, which gives them the choice of locking in a favorable exchange rate and then executing at a future date that is convenient for them. Forward contracts offer the benefit of allowing the customer to protect their assets from exchange rate movements. Limit order options are also available, which allow the customer to place the order on the condition that they secure the rate they want. NZForex specialists will only execute the currency transfer when the rate reaches the customer’s preferred exchange rate. Limit orders are often best for large currency transfer amounts, when the customer is not under a time constraint.

NZForex provides customers the ability to set up automated currency transfers for whatever their needs are, from mortgage payments to school fees, ongoing subscription fees, paying off a debt or loan, or any other type of ongoing payment. Fixed regular payments can provide protection against currency rate fluctuations, as they allow the customer to lock in a favorable rate up-front and then use that rate on an ongoing basis. Customers can also switch between fixed and non-fixed payment plans, allowing them to take advantage of a fluctuating exchange rate, to change the amount of the transfer, or to cancel it. Automated payments also offer the benefit of being transfer fee-free, which saves customers money, and they have a low minimum requirement of NZD$500.

NZForex business services are for businesses and corporate clients who need international money transfers and exchange risk management services. Advantages to NZForex’s services include dedicated FX specialists, an online platform available 24/7 with a variety of currency analysis tools, and lower rates than what are typically offered in a traditional bank.

Sending money abroad with NZForex gives corporate clients options so that they can manage their exposure to currency exchange risk. Spot contracts, forward hedging contracts, and limit orders are all available. NZForex also provides market tools to help businesses keep track of forex market changes.

Business clients can choose to establish automated payment plans for ongoing business payments, including rents or equipment payments, employee salaries, royalties, vendor supplies and services, or any other type of scheduled payment. The plans are easy to establish and can help businesses save money on transfer fees.

NZForex is part of the OzForex Group, which was first launched in 1998 as a website dedicated to foreign exchange information. The company now provides foreign exchange services and international payments services across six continents, with over 200 employees. In 2014, NZForex completed 581,000 fund transfers and had over NZD$14.6 billion in foreign exchange transactions.

Because of its OzForex connections, NZForex has access to banking relationships with a number of global banks, including UBS, Barclays, and Bank of New York Mellon.

OFX (previously UKForex in the UK), provides secure and speedy international money transfers to over 300,000 people in 55 currencies at better-than-bank rates

FXcompared may earn fees from this listing. Learn more

Excellent exchange rates | No transfer fees | Thousands of 5 star reviews

FXcompared may earn fees from this listing. Learn more

Great exchange rates | Specialist services | No added fees, 24/7 transfers | Safe and secure

FXcompared may earn fees from this listing. Learn more

Great rates | One-off payments | Regular transfers | E-Money Institution | No fees for FXcompared customers

FXcompared may earn fees from this listing. Learn more

One-off payments | Regular payments | Great rates | Safeguarded customer funds

FXcompared may earn fees from this listing. Learn more

Currency exchange specialists ranking No.1 on Trustpilot for the past two years

FXcompared may earn fees from this listing. Learn more

Banks are typically the most expensive way to do an international money transfer, and the quotes from the providers above show you the typical savings that can be made versus the average of a group of popular banks. All providers on FXcompared.com are regulated in the UK by the FCA, in the USA by FinCEN, In Canada by the SSC and Australia by the ASIC.

We check all rates regularly and this quote is an average from a group of major UK high street banks for this past month. It includes: Bank of Scotland, Barclays, Co-operative Bank, HSBC UK, Halifax, Lloyds Bank, NatWest, Nationwide and Santander GB – tracked every month. For more information on how the price comparisons are calculated, see our IMTI page.

Shop with PayPal and you’ll still earn your points, airmiles and cashback. Fees are shown as part of the overall exchange rate.

FXcompared.com is an fx money comparison site for international money transfer and to compare rates from currency brokers for sending money abroad. The website and the information provided is for informational purposes only and does not constitute an offer, solicitation or advice on any financial service or transaction. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. FXC Group Ltd and FX Compared Ltd does not provide any guarantees of any data from third parties listed on this website. FX compared Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from (i) any error, omission or inaccuracy in any such information or (ii) any action resulting therefrom.