Currencies Direct Review - Money Transfer Costs and FXcompared’s rating

Rating based on expert reviews by FXcompared

Daniel Webber

Founder & CEO

Daniel is Founder and CEO and has 20 years of experience in the international finance world focusing on cross-border payments, technology and the property sectors. Daniel is widely quoted as an expert within the money transfer industry including by The Economist, The Wall Street Journal, Reuters, CNBC and Bloomberg. Daniel is passionate about helping consumers and businesses find the best and most efficient ways to transfer money internationally.

Contents

- Who are Currencies Direct?

- Does Currencies Direct charge fees?

- How easy is it to use Currencies Direct?

- Can you use Currencies Direct on mobile?

- Is Currencies Direct trustworthy and reliable?

- What can Currencies Direct offer businesses?

- Where can you use Currencies Direct?

- Are customers happy with Currencies Direct?

- Is Currencies Direct a reputable company?

- Is Currencies Direct transparent on pricing?

Who are Currencies Direct?

Currencies Direct provides fee-free international money transfers and is best suited for those looking to sending larger amounts abroad, such as while emigrating or purchasing property overseas. It caters to both individuals and small to medium-sized businesses.

It was founded as a privately owned company in 1996, and remains privately owned today, with backing from two private equity companies. Currencies Direct was the first money transfer provider in Europe, opening its first office in Spain in the year it was founded. It has since expanded globally, and now has over 25 branches located across South Africa, Portugal, France, Spain, India, the USA and the UK.

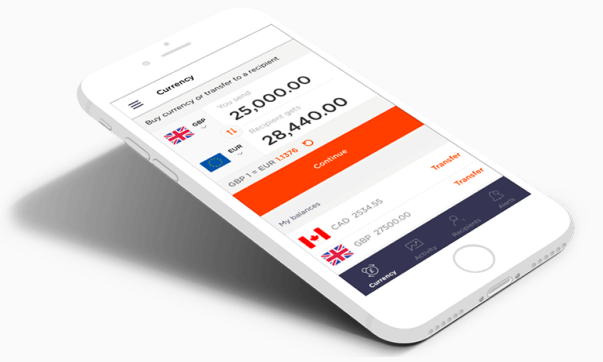

The company now trades in over 40 currencies, and provides services through its retail offices, phone service, online through its website and via the Currencies Direct mobile app. Having traded £10bn in currency last year, the company handled a large quantity of payments, with over 420,000 payments, and it has 425,000 customers.

Currencies Direct has received the highest level of creditworthiness, a Rating 1, from Dun & Bradstreet and is Financial Conduct Authority (FCA) authorised.