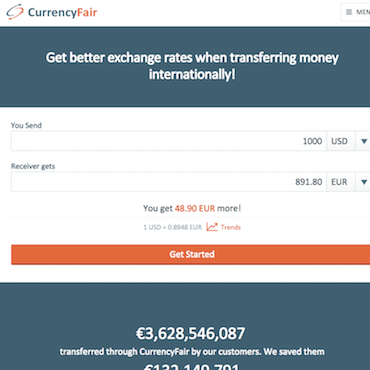

CurrencyFair is an online peer-to-peer money transfer company based in Ireland, with additional offices in Australia and the UK. The company was founded in 2009 and began offering international money transfer services to customers in 2010. CurrencyFair offers customers the ability to send money and receive money via transfers or international payments in 17 different currencies, with the ability to send money in an additional three currencies.

Easy to set up an account

Android and iOS apps

Regular payments ideal for pensions or mortgages

Personal and business accounts

Auto-transaction capability

Match to trade at your preferred rate

CurrencyFair takes on the trade if there’s no customer

Priority transfers service (attracts higher fees) to complete exchanges faster

No forward contracts to the US

Exchanges subject to live market rate

Can only add money to your account via bank transfer

CurrencyFair also offers money transfer services for businesses and corporate customers. Services include the ability to pay foreign invoices, remit profits to company headquarters, hold funds in a number of foreign currencies, and to make corporate foreign exchange transactions and foreign currency investments in a number of global locations. CurrencyFair offers businesses these services at much lower fees than what is traditionally charged at banks, and all transactions are safe and regulated by financial authorities in the countries in which they are transacted.

Founded in 2009, CurrencyFair Limited is an online peer-to-peer money transfer company headquartered in Ireland with employees in Australia and the United Kingdom. The company offers competitive exchange rates for sending and receiving money transfers and international payment services in 17 currencies, with the ability to send money in an additional three currencies. The company is regulated by the Central Bank of Ireland as an Authorized Payment Institution under the European Communities (Payment Services) Regulations 2009. The CurrencyFair Australia Pty Ltd office is regulated by the Australian Securities and Investments Commission (ASIC). As of October 2014, the company had processed over €1.2 billion in transfers for its customers.

CurrencyFair was one of four companies named “Best of Show” at the inaugural FinovateAsia conference in Singapore in November of 2012, and won the IIA Dot IE Net Visionary Awards for Most Insightful and Intriguing Internet Innovation.

Great exchange rates | Specialist services | No added fees, 24/7 transfers | Safe and secure

FXcompared may earn fees from this listing. Learn more

OFX (previously UKForex in the UK), provides secure and speedy international money transfers to over 300,000 people in 55 currencies at better-than-bank rates

FXcompared may earn fees from this listing. Learn more

Excellent exchange rates | No transfer fees | Thousands of 5 star reviews

FXcompared may earn fees from this listing. Learn more

Great rates | One-off payments | Regular transfers | E-Money Institution | No fees for FXcompared customers

FXcompared may earn fees from this listing. Learn more

One-off payments | Regular payments | Great rates | Safeguarded customer funds

FXcompared may earn fees from this listing. Learn more

Currency exchange specialists ranking No.1 on Trustpilot for the past two years

FXcompared may earn fees from this listing. Learn more

Banks are typically the most expensive way to do an international money transfer, and the quotes from the providers above show you the typical savings that can be made versus the average of a group of popular banks. All providers on FXcompared.com are regulated in the UK by the FCA, in the USA by FinCEN, In Canada by the SSC and Australia by the ASIC.

We check all rates regularly and this quote is an average from a group of major UK high street banks for this past month. It includes: Bank of Scotland, Barclays, Co-operative Bank, HSBC UK, Halifax, Lloyds Bank, NatWest, Nationwide and Santander GB – tracked every month. For more information on how the price comparisons are calculated, see our IMTI page.

Shop with PayPal and you’ll still earn your points, airmiles and cashback. Fees are shown as part of the overall exchange rate.

FXcompared.com is an fx money comparison site for international money transfer and to compare rates from currency brokers for sending money abroad. The website and the information provided is for informational purposes only and does not constitute an offer, solicitation or advice on any financial service or transaction. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. FXC Group Ltd and FX Compared Ltd does not provide any guarantees of any data from third parties listed on this website. FX compared Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from (i) any error, omission or inaccuracy in any such information or (ii) any action resulting therefrom.