BillMo Founder and CEO Steve LaBella is no stranger to the world of payments. Before BillMo, Steve previously founded global electronic payment company, iSend, eventually selling it to Ireland-based Ding in June of 2015. Seeing a new opportunity in Mexico, Steve founded BillMo in 2015 with a different approach to the traditional remittance business model in mind.

FXcompared’s CEO Daniel Webber sat down with Steve to discuss BillMo’s unique business model, the difference between targeting remittance senders and recipients and even, yes - what the current political climate may mean for the US-Mexico remittance corridor. Read on to learn more.

On the Traditional Remittance Company Business Model

Steve: Almost every remittance company out there is focused on signing up as many senders as possible. It’s a sender fee pay model, typically with remittance companies making their profits from fees as well as any FX mark-ups. Their focus is to get as many senders onto their network as possible. The result is that although recipients are part of the equation, they’re not really a group that the money transfer companies typically think about. To the money transfer companies, the recipients are just along for the ride, as we always say.

Senders vs. Recipients - How BillMo’s Model is Different

Steve: BillMo’s model is completely the opposite. Rather than focus on the senders, our focus is to onboard as many recipients as possible. The recipients are who we really ultimately consider to be our customers. Now, in order to do that today, we need people to send them money, so we are focused on acquiring senders too, but sender acquisition is for the ultimate purpose of signing up as many recipients as possible to BillMo. That’s one key difference between us and a traditional remittance company.

The other key difference, and I think the most important part, is our financial model. Again, a traditional money transfer company is focused on making money by charging the sender, and some companies will get creative in terms of how they target them. They may target new senders through mobile applications, or it might be in person - there’s some level of efficiencies in that - they can drive costs down for the sender. But our model is totally different - as we are focused on trying to make money on the use of the funds that are received in the remittance equation. Traditional remittance companies consider their job done once money is paid out. For BillMo, our job is just beginning upon receipt of funds.

Follow the Money

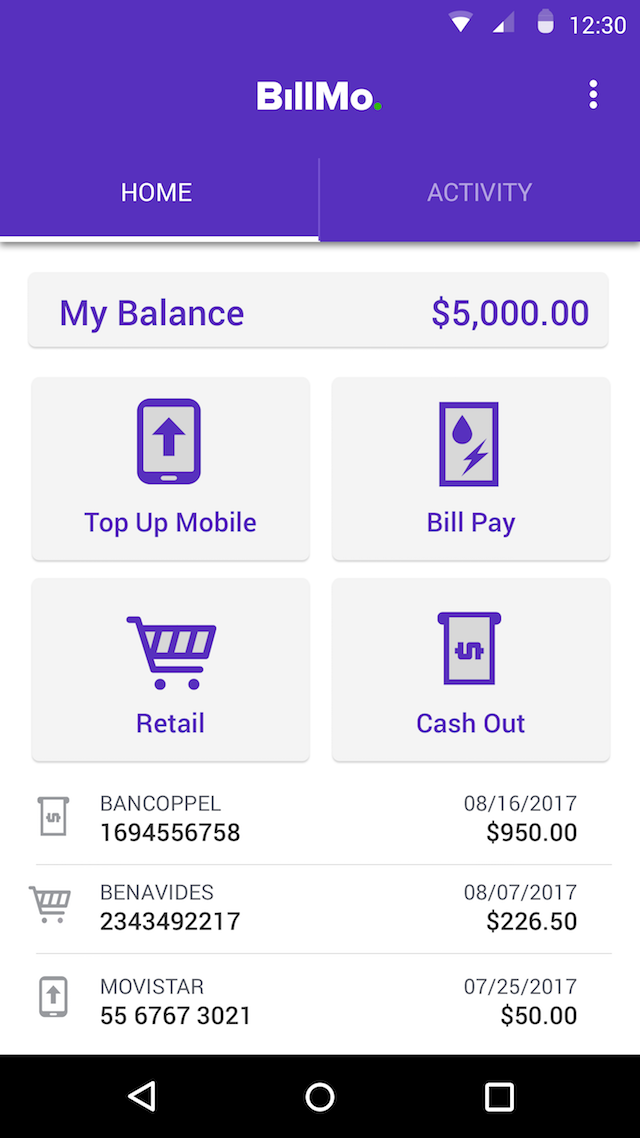

Steve: In the traditional way of sending money to Mom in Mexico - Mom picks up the money and the transaction is completed and everyone moves on to the next transaction. But Mom goes out and spends that money somewhere. Our goal at BillMo is to digitize as many of those transactions as possible and to help mom spend her money as efficiently as possible.

When Mom goes out and spends the money that has been sent to her, those are the points where we, as BillMo, will make money. If Mom buys airtime through the mobile app, we make money from the mobile operators. When she pays her bills, we get paid by the billers. When Mom shops at participating stores, we get paid with an interchange when she shops at those stores. BillMo is not charging Mom, we are charging the entities where she spends those monies.

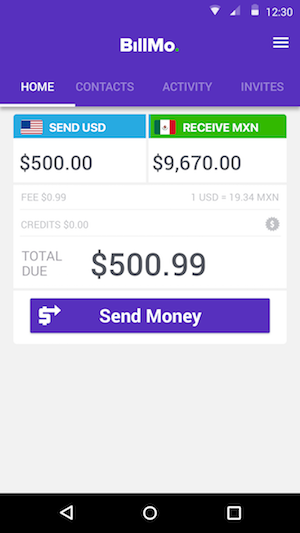

Because we charge the companies that accept payments via BillMo and make money on the use of the funds, we are, in turn, able to subsidize the sending of money. As a result, the cost and fees we have are ninety percent below what a traditional money transfer send amounts to. This is not because we want to be the lowest cost option for those sending money to Mexico - it’s simply because we are able to subsidize the cost of sending money based on the additional revenue from use of the funds by BillMo Users. This fundamentally makes us different than the traditional remittance business models.

Recipients Still Have Total Autonomy

Steve: The recipient has 100% control over how the funds are used, the sender simply sends money with the BillMo app the same way they would with any normal transfer. The recipient using BillMo gets notified that the money is received and they immediately have real-time availability of those funds. The user decides how they would like to spend it, in any portion of the different services we offer. I talked about digital spend features, but they also have the ability to take all or some portion of the fund they receive in cash, like they would a traditional remittance. When the user chooses that option, they can choose where they want to go pick up the cash. It might be at a bank, it might be at a retailer that is a traditional payout retailer in Mexico, but they can choose how much they would want to take out. The recipient of the funds has complete control over how the money is spent.

Recipients Surprised Us - Simplicity Is Key

Steve: Like any traditional send, if you’re sending money for a phone bill and the money gets spent at the movies, the recipient may ask for more money. BillMo can’t solve that problem - that’s a risk in any transaction that involves monetary assistance. The sender can’t control how the money gets spent. But in terms of what we at BillMo have been seeing for usage, it’s been incredible.

If you think about trying to launch in a financial services space – especially the one that we are playing in, where there’s sometimes general paranoia about new companies- there’s a certain challenge with asking a consumer to try something different or new.

We assumed upon our initial launch of BillMo that nearly 100% of sent funds would be taken out in cash. In fact, the original model had 100% of the funds being taken out in cash for the first year. We were focused on getting people familiar with using the service and getting people registered, so we could focus on growing our initial customer base.

We were surprised, however, by what users were doing with the funds once they were received. What we’ve seen is more than twenty percent of our transactions on the receive side are anything other than cash out. And that result has been with minimal effort on our part.

There are many things we can do in the future to incentivize usage of BillMo the way we want, and we are slowly introducing some of those incentives. But without doing much at all, people have really understood BillMo. We made the product incredibly simple, and users have been figuring out ways to use those funds in ways other than taking cash out. We are really encouraged by that, and it’s certainly positive news for the long term.

We feel both as the market for smart phones continues to grow in the markets we are in and as the comfort level, in terms of using smart phones for things like financial services and banking products becomes more comfortable for those users, our services will continue to grow. We are encouraged way beyond our initial expectations in terms of usage. We think it’s just going to get better and better over time.

We Haven’t Forgotten About the Sender

Steve: Though our business model depends on recipient spending, in reality we still focus on the sender. BillMo has not been marketed much in Mexico at all yet. We will do additional marketing in Mexico over time as we continue to offer additional ways to fund the wallet, but today we have really focused on driving sender usage so we can get what we call the “wallet holders” on board.

The only way we can get a wallet holder is to have somebody send them money. We plan to have other ways in the not too distant future, but right now, the only way to fund the wallet is through remittances. Because of this, from a sales and marketing standpoint, our focus is on acquiring as many senders as possible. We know the result of acquiring a new sender will be at least one, if not more, recipient with the sender, depending on how many people the sender is sending money to. So while our model is recipient dependent, we are growing that base by focusing on getting those senders. We’ve tried to do that by making it as seamless as possible for senders to move from their current money transfer company of choice to ours.

We know we have to deliver value to senders for them to consider making a change. And we are clearly doing that, given how fast we are growing. If you think about how the current sender sends money today, if senders generally send money via a mobile app, the process of sending with us is exactly the same as sending with any other company. We don’t ask the senders to do anything differently. If a sender goes to a retailer or an agent here in the U.S. to send in cash, we have the same process set-up, it’s the same. We haven’t asked the sender to change their behavior.

Mobile Top-Up and Bill Payment Drive Users

Steve: Mobile top-up and bill payment have been the predominant use cases. It’s simple and the app makes it incredibly easy. On the prepaid mobile side, you can both buy airtime for yourself and your own phone, which is how mobile is consumed in Mexico, but you can also buy it for your friends and relatives. So we literally have close ton1000 people today that are buying airtime for others, and in some cases, one of our promotions we have, a customer will get promotion credit for the more airtime they buy for other people.

We are seeing really great growth in that because it’s a simple thing, you just need to know someone’s mobile number and you can buy them airtime and literally you make money at it, if you do it to a certain level.

Growth on the Horizon

No question, geography is one of our big areas of growth, just moving to other countries certainly opens up our market and gives us the ability to grow. But we really also are looking to get deeper into our existing markets. We are doing that in a couple of different ways.

Number one, a lot of our focus today is to grow our acceptance network in Mexico. And that acceptance network is our retail acceptance network, where you can spend and pay for goods at checkout with our BillMo mobile wallet. Later this year, that network will grow from what today is a couple thousand stores, to upwards of over 100,000 acceptance locations, which we are really excited about.

We have a number of agreements in place that we are working through integrations to complete. The growth on the retail side and what we call our shopping side, really comes when the product is more ubiquitous. It’s one thing to have a couple of good chains, but it’s another to be seen and available nearly everywhere, so we will continue to push and grow that market.

Getting Growth Right By Knowing Our Customers

Steve: What comes along with that, and sort of the other growth pillar for us, is that we sit in a fairly unique position and we are able to deliver a lot of value to retailers that we work with in Mexico and other countries that we move to. And we can do that because we basically own the whole stack, we have the customer, we know where the customer is, we know how much balance they have on their wallet. We know historical spending behaviors and we know the moment they get money on their wallet.

We are working with retailers to provide them the ability to market different promotional things to our customers. So a simple example I always use is one that we are working on with a big pharmaceutical chain in Mexico that has doctors at all of their stores, and they want to promote that service to be used by customers, so we are working with them on being able to deliver a promotion to our customers. And even if it’s in just one area to test, we can find ways to drive customers to their stores based on a set of criteria around where the customer is and how much balance they have. Those are the kinds of things we can do across any number of retailers once we grow and expand that side of the business. All of those are revenue drivers for us, and all of those are partnerships that will get us deeper into the relationships that we are promoting.

On BillMo as a Mobile Wallet

Steve: There’s no question we will expand the methods in which you can load funds onto the wallet. Remittances is one of the more obvious ones, and it’s a market that we’re able to, again, subsidize and drive growth. We are working on being able to add government assistance payments, being able to add payroll directly to the wallet, and then just general self funding with your own debit card or bank account.

In the future there will be a variety of different ways to get funds onto the wallet beyond what the current method is, which is just remittances. When launching BillMo, we decided to make that Phase Two, as opposed to Phase 1. Despite how obvious the value proposition of a mobile wallet is, I think it would have been very difficult to get people to sign up directly for it. We decided to grow a customer base through use of remittances and offering those customers the ability to do more down the road.

Competitors Can Be Friends

Steve: While companies like Western Union or Xoom may think of us as competitors, and I suppose we think of them as competitors, the reality is, I’d just as soon work with them. Again, my customer is the recipient. The original process we were going down was actually to partner with money transfer companies and have them be the send network and we’ll be the receive network, essentially. And we got a variety of different responses from that, and I know lots of people, all the biggest companies. The responses ranged from laughter to actual relationships - so we actually do partner with some money transfer companies today, who are part of our send network. Which is great, it’s just, it makes them a little bit uneasy, because of what we are doing - so it’s always a little bit of an uncomfortable relationship because of that.

Our real desire at BillMo is to grow our recipient network as much as possible. We sort of sit in the middle of all that, and I would say if you ask most companies who are aware of us, they would tell you we are a competitor, and I would argue, long term, I don’t even necessarily want to be in the money transfer space, I can let them do all of that.

They All Laughed - But Stats Aren’t Everything

Steve: Before we launched BillMo we talked to many people in the remittance space. Would recipients like the service? Would they even want the service? When we brought people the idea of a mobile wallet focused model, well, that’s when some of the laughter came in.

A lot of people we spoke with told us that recipients in Mexico don’t have smart phones, that they’re not that tech savvy, it’s just not going to work - it’s not what they want. Thankfully, we’ve found the exact opposite.

Sure, maybe Grandma who lives further out in a rural area doesn’t have a cell phone at all, but the market has been incredibly receptive to our product and the offering and the way that we offer it, and we are seeing great uptake as a result of that. And that was really kind of the big bet that we had.

You can look at the stats all you want, but until you actually put the product out and see how customers react to it, you just don’t know. We are thrilled to see that every month we’ve grown faster than the prior month, and we will continue to do that. We are seeing great reception to the product and to the uses of the product. As customers get more comfortable with the technology, more comfortable with doing more things on their phone, we will be along for that ride.

The Regulation Hurdle

Steve: We probably feel the same way most people feel about regulations - it’s onerous, it’s challenging and sometimes burdensome. But the reality is, you put your head down and you get through it, and it really has not been as challenging as I think others sometimes make it out to be. We continue to get licensed in more and more states. It’s not fun and sometimes it takes much longer than you want it to, but it is what it is. We are all on the same field, we are OK with it, it is somewhat of a barrier to entry in a lot of cases, but we are working our way through it. And we have done it successfully.

Certainly, given my preference I would not want to do it, it’s an expensive process. But we are very well funded, we are a venture backed company, most of the proceeds from the iSend sale are being used to launch BillMo, so we’re in a great position financially, and that’s sort of what’s made the process easier for us compared to a company that’s sort of starting up on their own.

The New Great Wall

Steve: Without question, the current potential challenge of US-Mexico money corridor is not something that we predicted. We can think about it in two different ways. First off, if you think about launching a year ago, there’s sort of good and bad about this. 2016 ended up being a record year of transfers from the U.S. to Mexico, which you could argue is perfect timing for us. We got into a market that was already big and then had one of its biggest growth years ever, and so the timing from that perspective was great for us. In terms of the ending of the year and the political climate, you’re certainly right, there’s little we can do to influence one way or the other.

26 plus billion dollars a year goes from the U.S. to Mexico. That number has grown and shrunk over the years, but it’s always stayed in the 22-26 billion dollars a year, even at the worst of times. US-Mexico money transfer is a massive market and we are just getting started. So despite the current political climate, there’s just a ton of upside for us. We are keeping our heads down and continuing to grow our customer base.

We’ll see how it all shakes out, but BillMo is continuing on the path that we’re on right now with a lot of potential in front of us.

Oanda CEO Vatsa Narasimha On the Future of Money Transfer

Mike Massaro, Flywire CEO Interview - On Money Transfers and Receivable Payments