In today’s market, it’s all about the apps. At this year’s Money20/20 conference meanwhile, it’s been all about mobile and frictionless payments. The big brands are launching new apps, while analysts are using mobile metrics to inform valuations. And according to our recently-completed survey on consumer money transfer, the mobile field remains wide open.

Roughly 20% of U.K. consumers recently transferred money internationally. Of those, only 11% used a mobile app in the 12 months prior to our survey.

Other Mobile App Reviews

- Ria Mobile App Review

- Transfast Mobile App Review

- Viamericas Mobile App Review

- Small World Money Mobile App Review

- Xoom Mobile App Review

- World First Mobile App Review

- Western Union Mobile App Review

- Skrill Mobile App Review

- Remitly Mobile App Review

- Transferwise Mobile App Review

- OFX Mobile App Review

Lacking Churn

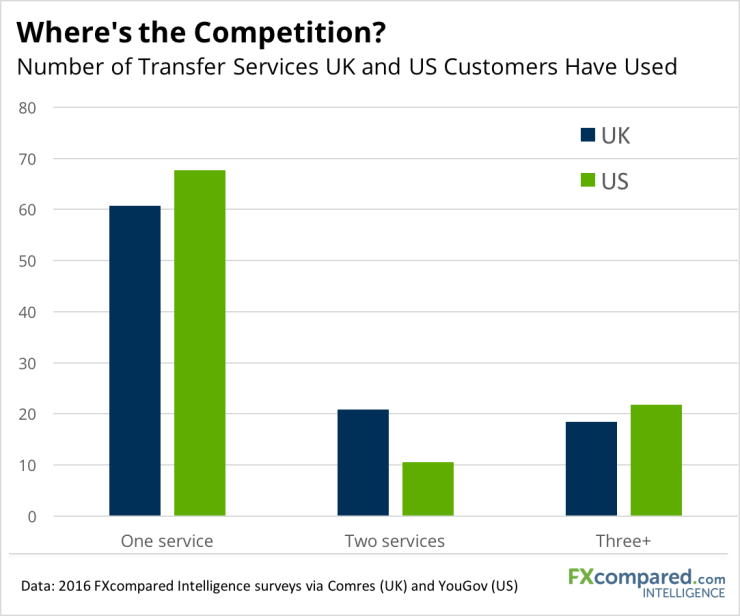

We've also looked at the number of non-bank transfer services customers in the U.K. and U.S. have used. Our results suggest approximately 60% of consumers who have transferred money internationally have only ever used one non-bank money transfer service.

As the industry continues to push into mobile, companies may be better able to use their new mobile offerings to attract customers and incentivize greater churn within the market.

It's Still a Mobile Competition

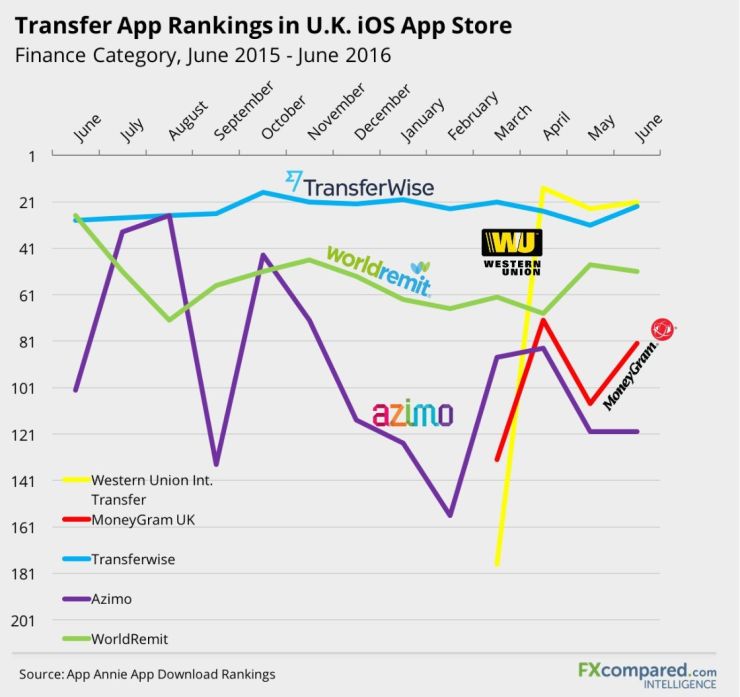

Even if mobile use isn't the norm yet, usage is only going to increase. Here's how some of the major players stack up in terms of app rankings. Unsurprisingly, U.K.-native TransferWise has consistently out-ranked competitors. Perhaps more surprisingly, Western Union's recent app entry poses a real challenge. After being launched in early 2016, it quickly rose above TransferWise in March, and has remained roughly even since then.

(click graphics for additional insights from our 2016 money transfer report).

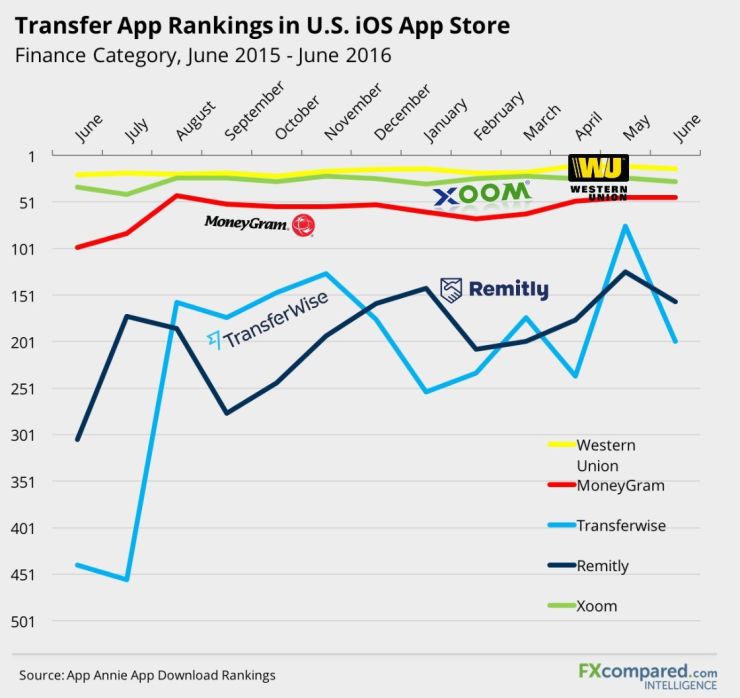

In the U.S. however, TransferWise and Remitly have struggled to gain footholds against incumbents such as Western Union, Xoom, and MoneyGram. This may partially be due to the “home field advantage” of such established players who have - in the case of Western Union and MoneyGram at least - spent decades advertising their products and building brand loyalty across the U.S.

As more companies dedicate resources to their mobile offerings, app competition will likely only intensify. Likewise, the introduction or rise of truly mobile-first services such as M-Pesa into developed markets such as the UK and US may alter the mobile landscape in the future.

What Everyone's Was Talking About @ Money20/20

While I was at the Money20/20 conference in Las Vegas last week, I had a chance to listen to some of the largest payment companies lay out their vision for the future. Here's a few insights I gathered:

Everyone is getting into mobile (we told you), but not in the same ways. Western Union is taking a comprehensive approach with their new app, bundling together their various products. Xoom on the other hand is focusing on new features such as bill payment for overseas recipient believing this will add to total monthly sending values.

"Frictionless" is the new synergy. Ease of use is the top priority for payment giants like Google and Square, but bringing such simplicity to international payments may be more challenging. Western Union alone employs ~2500 people for compliance (~25% of its workforce), and red tape = friction.

Want Insights Like These In Your Inbox?

Our weekly newsletter is packed with insights into the FX, international payments, and money transfer industry.