FXcompared

Money Transfer Report 2018

Part 1

The Money Transfer Industry Evolves

More Consolidation and Major Investments

The Movement Towards Profitability and Brand Development

Part 2

Digital Currency Business Models Evolve

Other Areas of Growth in International Payments

Executive Summary

- As the industry develops and shows the first signs of maturing, players who once won customers purely on a price for single payment are now having to expand their offerings to compete with one another and the more sophisticated customer that they have created.

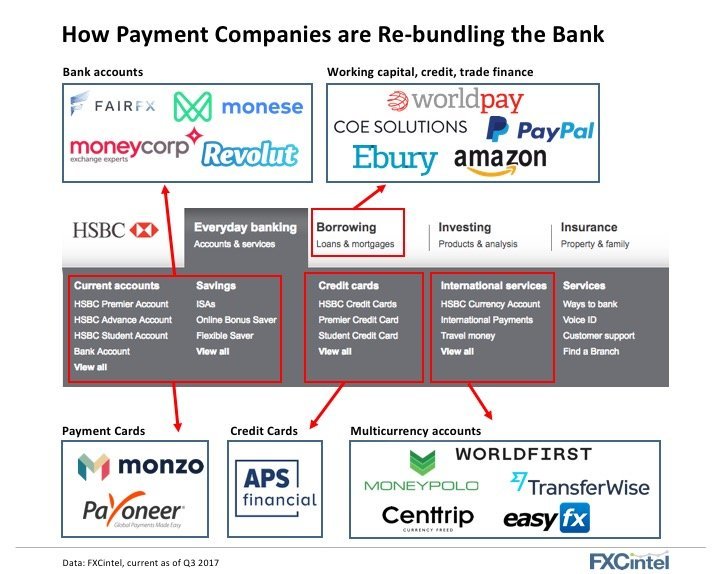

- Industry players have begun offering broader product sets and services, which often overlap with those of big banks. A few major players introduced multi-currency accounts, while others have developed traditional banking products like travel money, trade finance, payment cards, and even current accounts.

- Markets such as the UK and Australia remain further ahead in market development compared to the likes of the US, parts of Europe, and the emerging markets.

- Companies are looking to build deeper relationships with customers as they gain more insight into customers’ overall financial product use. Those with big marketing budgets have begun to see a return on their spend and development of brand equity.

- Money transfer players are recognizing that it takes more than just cheaper spot payments to remain competitive. They also need to continue addressing other significant pain points such on-boarding, multi-platform needs, and the desire for “one-stop shopping.”

The Money Transfer Industry Evolves

Diversification and Improvement of Offerings Looking More Like Banks

In 2017, TransferWise, WorldFirst, and Easy-FX debuted multi-currency accounts as convenient alternatives to the slowness of the traditional system, which required establishing bank accounts around the world. Whilst mutli-currency accounts are nothing new and have been offered by banks to select customers for many years, it is the launching and marketing of these products to the masses that is the change. This trend was driven by the demands of businesses and online sellers, who often encounter frustration when trying to open multi-currency accounts with banks and transfer money into and out of those accounts.

In some markets, including the US, many banks don’t even allow SMEs (small and medium sized businesses) to hold multi-currency accounts. With more and more banks returning to single country strategies as opposed to global empire building, hardly any company can be served internationally by its home country bank. This has opened the doors to all these new products.

TransferWise, which started out as a bank alternative that focused exclusively on cross-border payments, began imitating big banks last May with the launch of its “Borderless” multi-currency account. While TransferWise has not yet stated that they will offer interest bearing deposit accounts, it may reconsider if customers begin holding funds in Borderless Accounts for long periods. It’s also easy to imagine the company integrating lending into their service options, given that many stand-alone SME lending platforms have strong track records.

Monese, an e-money company launched in the UK in 2015, became the country’s first mobile only bank account. Aiming to ease the hassles that expats, immigrants, and nomads experience when attempting to open bank accounts in their new country, Monese eliminates the need to present proof of residence or a credit history. High Street Banks usually require a passport and documentation of a UK address, such as a utility bill, which means that newcomers can wait up to six months for that documentation to become available. In contrast, Monese performs a quick check of a potential customer’s digital footprint through its proprietary KYC (Know Your Customer, a regulatory requirement) platform.

While Monese also provides international payments, they’re winning customers for other reasons, claims CEO Norris Koppel. Koppel doesn’t consider Monese a direct competitor of banks, because it offers a “light” bank account with a unique focus. “We don’t want to build everything ourselves, so unlike banks we want to keep everything light. But we want to aggressively expand our territories and make our technology available on a global scale.” Monese works with people who have been rejected from banks (30% of new arrivals from abroad), so in that sense it performs a complementary role. In fact, the company is planning to partner with banks to get them to channel rejected customers to Monese. At the time of our interview with Koppel last November, Monese was up in running in 20 countries.

Moneycorp decided to go all the way when it comes to emulating banks by acquiring its full banking license and offering interest bearing accounts, so it is now literally a bank. In our interview with CEO Mark Horgan last summer, he explained the reasons for this decision. Given that Moneycorp relies on banks to supply its liquidity and distribute its payments, it needs to comply with certain standards that are even higher than those of banks. As a result, Moneycorp was experiencing all of the cons (e.g., tight regulations) yet none of the pros of actually being a bank. “So I had a view that, if you’re going to act like a bank, you’re going to be treated like a bank, you’re going to be structured like a bank, you’re going to have IT systems like a bank, you may as well have a license because it will give you access to the upside.” The upside includes the ability to pay interest on accounts, hold deposits for extended periods, raise liquidity and lend.

As open banking pushes for greater transparency when moving funds across borders and makes switching to a new provider easier, big banks are no longer firmly in control. They can’t depend on owning the customer relationship from the beginning. If customers can get all of their needs met outside of the established financial system, they may not see a need for a traditional bank account at all. Here’s a snapshot of which payment companies are offering which banking products and services:

Embracing E-Money Licenses

Consistent with the trend towards diversification of offerings and adoption of banking services, an increasing number of payment companies and fintechs have been acquiring e-money licenses over the past two years. Such a license is more comprehensive than an authorized payment institution license and is often perceived as an intermediate step towards a full banking license, or at least towards a wider range of offerings, particularly as it allows for wallets and multi-currency accounts. It’s an indication that the payment company aims to venture beyond the pure money transfer space.

The following graph illustrates the recent rise in the number of e-money licenses granted to payment companies in the past several years:

The UK continues to be the base for many European payments companies, but with Brexit on the horizon, it may not retain this position. Companies are already beginning to either set up or move their offices out of the UK. Moneygram has set up an office in Brussels, and we expect to see an increase in companies getting regulated out of Ireland. The US continues to place a disproportionate regulatory burden due to its state by state requirements. Asia, as we cover later in this report, has seen good growth in new players due to lighter regulation and the high adoption of mobile amongst consumers.

Differentiating through Cryptocurrencies and Consumer Lending

Payment company Abra initially stood out from other money transfer providers as it pivoted from being a remittance company utilizing bitcoin to a Bitcoin wallet that allows customers to easily, buy hold, and invest in the digital currency. Last fall, it received a £11.8m ($16m) Series B capital infusion, which was spearheaded by FoxConn, the Chinese consumer electronics giant that manufactures iPhones and parents the Sharp home appliance brand. The new relationship will enable Abra to further differentiate itself with a new use case: financing for consumers who can’t afford to buy a manufactured product, such as an iPhone or large household appliance, all at once. The security features of Abra’s blockchain technology, as well as its micropayment and smart contract functionality, can make the financing and repayment process more efficient and more inclusive of underserved consumers. “We foresee a whole new market growing in this area of consumer asset finance," stated Abra CEO Bill Barhydt.

Others have followed fast though. Revolut, an up-and-coming player in the UK, now offers several cryptocurrencies, and others such as Veem and Wyre are using the blockchain to power their product. Companies such as Ripple are using their own currency (XRP in Ripple’s case) to begin to power cross-border payments, and they have signed agreements to work with some major money transfer providers like Moneygram.

Improving the Customer Experience

In addition to more types of services, payment companies strove to provide better ones in 2017. For example, many focused on improving the customer on-boarding experience by reducing the amount of steps and information required during the account set-up process. This is a natural evolution of product experiences as companies learn from best practices. Before a customer initiates a transaction, all payment companies must collect and verify identifying information on that customer in order to comply with KYC/AML laws and regulations. However, prior to that step the amount of information requested varies widely by company. Our chart below shows how varied the approaches to this critical first part of the journey still are, and how some companies make setting up an account so much easier than others:

Overloading potential users with tedious requests before they’ve even established an account can cause them to give up and jump to a competitor instead, so streamlining the on-boarding process is key to growing a company’s customer base. Some companies make on-boarding as simple as possible by allowing people to create accounts through their existing social logins. As shown in this chart, only a small subset of companies--TransferGo, Xendpay, TransferWise, and Azimo--have maximized this strategy by allowing user to sign up with either their Facebook or Google login credentials:

Of note, it’s not the case that only the traditional money transfer providers require a lengthy set-up process. For example, the startup Revolut does too. Given how expensive it is to get potential customers to the point where they’ll download a company’s app, losing them right after that point--before they can initiate a transaction--ends up wasting the upfront investment. Reevaluating their on-boarding requirements will be important to remaining competitive as these companies move forward in 2018.

More Consolidation and Major Investments

A Shift in Sentiment: From Competition to Collaboration

Over the past five years, competition in the money transfer space intensified as more fintech startups, as well as bigger corporate players, entered the field. However, there has been a recent shift from head-to-head competition towards partnership and collaboration, a trend which is expected to continue into the foreseeable future. Both traditional providers and challenger fintechs recognized that they weren’t necessarily playing a zero sum game with the competition. As challengers encroach on traditional banking products, bank have responded not through direct competition but instead by partnering with those challengers.

It isn’t realistic to expect that traditional providers will ease all customer pain points or that challengers can single-handedly disrupt the entire industry. So big and small organizations are working together to contribute their respective parts of the value chain.

Mergers and Acquisitions

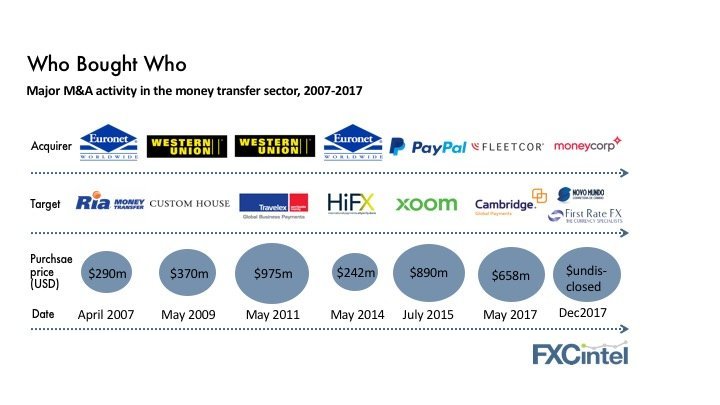

The pace of consolidation is picking up, as illustrated by the graphic below:

Interestingly, Cambridge was purchased by a financial services companies with no specific international payments experience. Fleetcor is a £9.6b ($13b) US public company specializing in fuel cards and employee payment products.

It beat out private equity, which boasts plenty of cash reserves, as well as money transfer incumbents, who would have benefitted from synergies. Fleetcor justifies its purchase of Cambridge, which is based in Toronto, with the need for entry into the international payments market. Now it can offer clients international AP services in addition to domestic ones. Fleetcor expects the acquisition to add to its bottom line, as Cambridge is a profitable company with an annual FX flow of £11.8b ($16b). Before it got bought, Cambridge was one of the largest independent players in the B2B international payments sector.

At the end of a highly profitable 2017, international money transfer firm Moneycorp announced plans to acquire two companies: Novo Mundo Corretora de Câmbio, a booming foreign exchange business in Brazil, and First Rate FX Ltd., a UK-based currency specialist. Two years prior, Moneycorp had invested in the Brazilian business, and now it’s aiming for a majority stake. First Rate FX Ltd. brings 13 years of experience in foreign exchange, as well as a high transaction volume (20,000 between 2016 and 2017), to the table. Its founders, Lisa and Christopher O’Brien, will become part of the Moneycorp Group’s leadership team.

Through this international and domestic expansion, the Moneycorp Group will establish a firmer foothold in the international payments market, as it transfers customers from the acquired companies onto its own robust payments platform.

One proposed major acquisition failed to come to fruition due to wary US regulators. Ant Financial, a deep-pocketed affiliate of China-based e-commerce star Alibaba, won a bid to purchase Dallas-based MoneyGram for £885m ($1.2b). However, despite repeated attempts, the deal did not gain approval from the Committee on Foreign Investment in the United States (CFIUS). Ant Financial’s struggle highlights the increasing difficulties that Chinese-based companies face, no matter how influential they are, when attempting to buy US businesses. CFIUS expressed concerns about data theft by foreign countries, which have been heightened by the recent Equifax breach. (There is speculation that the breach was caused by Russian or Chinese hackers.)

Now that the deal has fallen through, leading global payments provider Euronet may be next on deck. Last April, it’s bid fell short of Ant Financial’s (£11.22 ($15.20)/share versus £13.28 ($18)/share), so it may appreciate the second chance. MoneyGram and Ant Financial said they now would divert their energies towards strategic initiatives in the cross-border payments market.

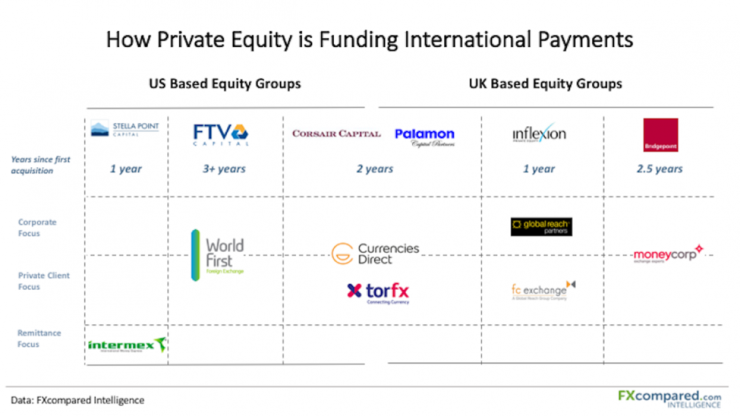

How Private Equity is Funding International Payments

Even though the flow of venture capital into the international payments sector seems to attract more publicity, private equity has also been playing a highly influential role. The following chart shows that we are about mid-way through the PE firms’ typical 5-7 year investment cycle (i.e., the length that most firms hold their positions).

This cycle’s earliest investors, Bridgepoint and FTV partners, chose to focus on a single payment company (Moneycorp and World First, respectively), whereas newer entrants prefer a buy and build strategy that develops scale in key geographic regions and customer segments. Stella Point Capital stands out as the only PE firm to support the remittance market. They acquired Intermex, which specializes in the US to Latin America corridor, last year. Intermex itself sprang out of a prior PE consolidation.

In the previous cycle, Apax held its position in Travelex for an above-average 9 years, exiting in 2014, and a variety of PE firms stuck with OFX for between 4 and 7 years. All of these firms had exited by 2013. Given the estimated £605 ($820b) of PE funds that are ready to take aim, patterns like these should continue into the future.

Funding Drives Consolidation and Expansion

PE money has been driving consolidation, which creates the scale necessary for payment companies to stay competitive and comply with regulations. But VC funding for major industry players threatens to surpass that of PE firms. To date, TransferWise has raised a total of almost £300m ($400m), WorldRemit secured over £170m ($230m) of capital, and Remitly captured £159m ($215m).

With more resources at hand, these companies are now venturing beyond their particular markets and going after each other’s customers. For example, TransferWise is marketing to businesses, and Seattle-based Remitly has made the jump to the UK and is looking further afield from its US base. Originally focused solely on money transfers from the US to the Philippines, Remitly gradually added Mexico, India, and several other new corridors. It is bringing that same approach to the UK of targeting the biggest corridors first and expanding from there. The raising of venture debt in the market has shown that companies are maturing and that they are able to offer clearer paths to a return on investment.

The leap for international payment companies into the US from outside remains a rarer occurrence due to the daunting upfront investment of time and money that is required to get regulated and then to market successfully. OFX, WorldFirst, Transferwise and WorldRemit all entered organically, whereas Moneycorp initially entered by a partnership (with Tempus) but then bought Commonwealth Foreign Exchange. Either way, these companies will all need a huge marketing budget to develop brand recognition and acquire new customers, as well as enough resources to comply with the US’s state by state regulations.

Facebook Still on the Sidelines

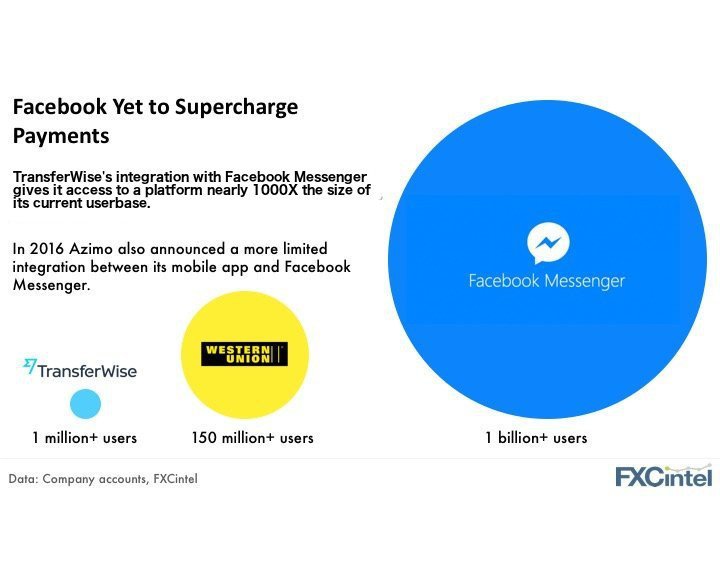

Despite fears that the most popular social media platform could swallow up the payments industry whole, Facebook is not an immediate threat at this point, especially if it’s viewed as a partner rather than a competitor. Earlier this year, TransferWise partnered with Facebook to enable international payments inside the Messenger app, which boasts over a billion users. As shown in the following graphic, more than a million people use TransferWise, so the collaboration with Facebook gives it access to 1000 times more users. Despite this huge potential, however, Facebook has yet to make a big difference in TransferWise’s reach. Other payment companies have followed with Facebook Messenger integrations, such as Azimo.

The Movement Towards Profitability and Brand Development

TransferWise Hits its profit Milestone

Before 2017, the common perception among banks and traditional payment companies was that challengers in the industry could not sustain their business models, which tend to center around internet or mobile money transfers, and achieve profits. That perception underwent a major shift when TransferWise announced its first ever profit last fall. Revenue more than doubled in the fiscal year ending May 2017, from £28m ($38m) to over £69m ($94m), leading to a small operating profit of £800,000 ($1.1m).

The news came as a big surprise, in large part because TransferWise’s financial report for the prior fiscal year (through May 2016) indicated a record loss of £17m ($25m). In addition, it raised less money in 2016 than it had in 2015 (£17.3m or $23.4m versus £39m or $53m). This graph shows why TransferWise’s profitability was hard to predict:

TransferWise was able to turn things around for many reasons, including reductions in the cost of customer acquisition as the company scaled up. Also, word got around the UK quickly that TransferWise offers below-market pricing and a full range of user-friendly mobile and online payment services. With these advantages, It’s hard for customers to come up with a reason to leave, so the retention rate is strong. “We’ve shown that you can be a sustainable company while charging the least amount possible and passing on the savings gained from innovation to end users,” stated TransferWise co-founder and chairman Taavet Hinrikus.

The Biggest Players Are Attracting More Funding

While profitability is just a budding phenomenon for challenger payment companies, investors must anticipate more of it down the road given how much capital they’re putting into them. There was a particularly remarkable bout of investments last fall. In the course of just a couple weeks, several UK companies raised a combined total of over £350m ($474m). TransferWise, ever the dominant player, took home the top prize with a £211.2m ($286.3m) round based on a valuation of £1.2b ($1.6b). Its rival Remitly announced soon after that it was in the process of closing a Series D round of just under £100m ($136m). (The round was approved by regulators in December.) Monzo, a “bank of the future” built for smartphones, secured a £71m ($96.2m) round, which brought their valuation to £280m ($380m).

Given their vast new resources, these companies can be expected to expand both operations and product offerings. The cash influx should accelerate the trends of emulating banks and targeting SMEs. For example, TransferWise will likely expand its Borderless account, and Monzo is fortified to win over more customers of traditional banks.

Next door in Ireland, TransferMate got a £26.7m ($36m) boost from Allied Irish Banks (AIB) in exchange for a small minority equity stake. The investment values the Kilkenny-based international payments company, which is part of businessman Terry Clune’s Taxback Group, at £222-267m ($301-362m). The new relationship includes a strategic partnership aimed at giving AIB’s business customers access to TransferMate’s global payments technology platform. It’s "a great example of how a leading bank and a fintech company can work together," stated Clune. With the new cash, TransferMate can simultaneously grow its head office and its commercial teams in the US, Canada, Australia, and Europe.

A statement about the deal from AIB highlights a larger industry shift in the attitude of big banks towards more nimble and higher-tech challengers. Rather than competing with them, they’re joining forces. "The investment is in line with AIB's strategic priority to increase the pace of innovation to serve changing customer needs by working with both dedicated internal teams and with external partners and startups.” TransferMate had done a lot of legwork to acquire regulatory licenses around the world, and now AIB can share the benefits.

Building Trusted Brands: Online Reviews and Sports Sponsorships

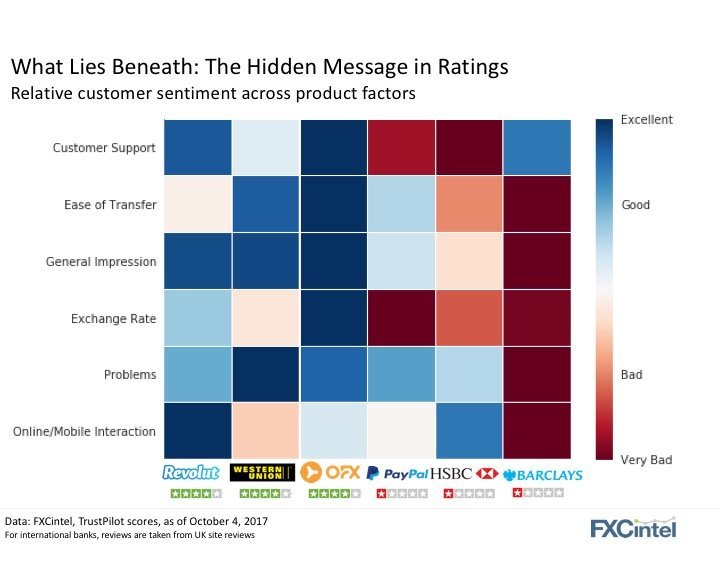

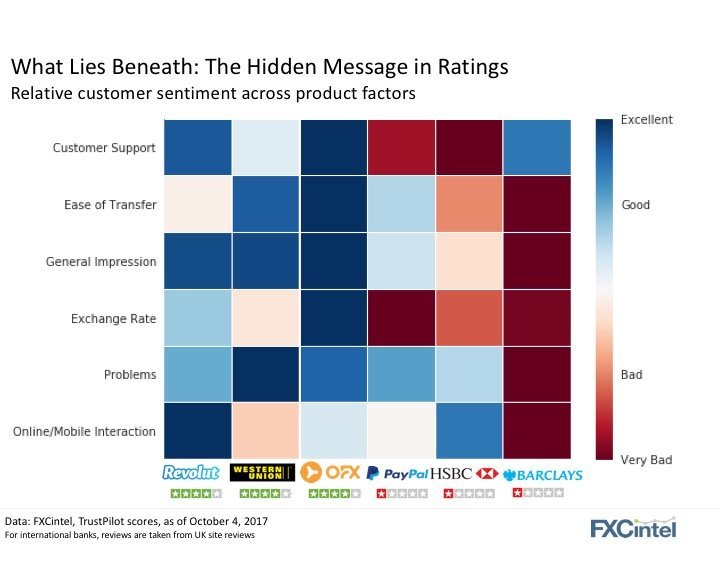

Newer payment companies face a variety of marketing challenges when competing with traditional ones, which are firmly entrenched and well-resourced. However, they also possess several advantages, including technical savvy, ease of use, lower costs, and the strong appeal to younger consumers that all those strengths entail. In order to tease out what customers specifically like and don’t like from overall customer feedback, payment companies need to look beyond average star ratings on review sites. Different companies could share the same rating but for vastly different reasons, so it’s important to consider individual comments as well.

Our research team conducted sentiment analysis of individual customer feedback from reviews of a large number of payment companies across a variety of product factors, such as customer support and ease of transfer. The following snapshot of our analysis shows how looking deeper tells companies specifically where they’re doing well and where they need to improve.

In addition to managing and carefully considering reviews, payment companies need to identify ways of developing their brand that are novel yet provide a strong ROI. For example, the last couple of years have witnessed a spike in sponsorships of popular sports teams:

In 2017, Western Union became the first ever Official Shirt Sleeve Sponsor of Liverpool Football Club, and WorldRemit embarked on a partnership with the Arsenal Football Club as its Official Online Money Transfer Partner. Both companies aim to grow their audiences by linking themselves with brands that have inspired vibrant global communities. According to Jean-Claude Farah, President of Global Payments at Western Union, “The business of Western Union and Liverpool FC are both driven by our passion for bringing communities together…This partnership goes far beyond a badge on a shirt, as we will be bringing our digital money transfer expertise to better connect Liverpool FC fans around the world.”

Football has been the most popular sport to sponsor among international payment companies, and on the surface it’s a logical choice because of its international reach, big crowds, and fiercely loyal fans. However, the investment in football may not bring the greatest return, especially for companies with smaller budgets. More specialized sports that are popular with expats and/or high-income individuals, such as speed-skating, badminton, triathlons, or biathlons, may be a safer bet. They bring a well-defined audience at much lower costs. It remains to be seen whether the next sponsorship will stick with a traditional sport or venture off the beaten path.