Before Rajesh Agrawal immigrated to the UK from India in 2001, he was earning about £50 a month. Four years later, he and his business partner founded RationalFX, which became a hugely successful international money transfer provider. Wanting to leverage this success for the common good, the founders created an offshoot of RationalFX that aims to help migrants send money home as cheaply, safely, and transparently as possible. And thus was born Xendpay.

Transfer Fees and Exchange Rates

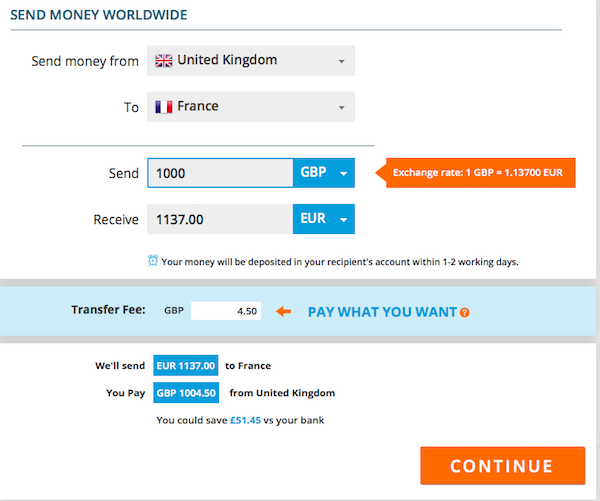

What most distinguishes Xendpay from other online money transfer services is its Pay What You Want (PWYW) model. For transfers up to £2,000 a year (or its equivalent in other currencies), individuals can set their own fees. Xendpay suggests a fee that it thinks is fair, but users can adjust it according to what they think is reasonable and affordable. For businesses, the upper threshold for discretionary fees is £4,000 per year.

Even for transfers with required fees, costs are low. Xendpay usually charges 1.4% or less, depending on where the money is going. (Expect additional, third-party fees when paying with a credit card or with a debit card outside of Europe.) And Xendpay’s excellent foreign exchange rates receive praise from customers. The company prides itself on a simplified, friendly interface that makes all costs--and savings compared to banks--transparent to the user:

As another gesture of good will towards migrant workers, Xendpay has launched a Payday Initiative that eliminates all transfer fees regardless of transaction size during the typical month-end payday period (for first-time users only). CEO and Co-Founder Paresh Davdra calls it “the latest chapter in Xendpay’s mission to help migrant communities support their families and friends overseas. Whether this is to help fund education, provide supplementary income or pay for bills.”

How does it work?

Xendpay lets individuals and businesses send money online to 173 countries around the world. Using the web site or mobile app, they can register with Xendpay and then transfer money from their bank account or credit/debit card. Funds can be deposited in the recipient’s bank account or, in some countries (e.g., the Philippines and Kenya), a mobile wallet. The money usually arrives quickly, within 1-3 business days.

Xendpay relies on RationalFX, which is authorized by the Financial Conduct Authority (FCA), to process its transactions. FCA regulations require customer funds to be stored in segregated accounts that are protected in case the financial services provider goes bankrupt.

Customer Feedback

Xendpay is popular with customers and boasts a four-star rating on Trustpilot. Positive comments relate to the excellent service, favorable exchange rate, intuitive interface, competitive fees, fast delivery, and responsive staff. Mixed into this glowing feedback are rare complaints about delays or poor service.

More About Xendpay

Xendpay has 70 employees spread among its London headquarters and three additional offices in Birmingham (UK); Marbella, Spain; and Lille, France. To fulfill its pledge to the Clinton Global Initiative, Xendpay aims to save people £60 million in transfer fees over the next 4 years. Xendpay is endorsed by Jimmy Wales, the founder of Wikipedia, who considers it "a welcome challenge for an industry that has for too long taken too much in profit from individuals sending money overseas."