WorldRemit Review

Rating based on expert reviews by FXcompared

Daniel Webber

Founder & CEO

Daniel is Founder and CEO and has 20 years of experience in the international finance world focusing on cross-border payments, technology and the property sectors. Daniel is widely quoted as an expert within the money transfer industry including by The Economist, The Wall Street Journal, Reuters, CNBC and Bloomberg. Daniel is passionate about helping consumers and businesses find the best and most efficient ways to transfer money internationally.

About WorldRemit

WorldRemit is an online service that allows people to send money to friends and family living abroad, by using a computer, smartphone or a tablet device. Founded in London by a former compliance advisor to the United Nations Development Programme, WorldRemit has been providing online money transfer services to migrant workers and expatriates since 2010. It is owned by Zepz Group.

The company is backed by venture capital companies, including Technology Crossover Ventures and Accel Partners, and provides individuals with a secure, low-fee option for sending money abroad and making international payments. The firm provides transfer services from over 50 countries to over 130 destinations worldwide, throughout the Americas, Europe, Africa, Asia, and Australia.

Contents

- WorldRemit transfer fees and costs

- Usability

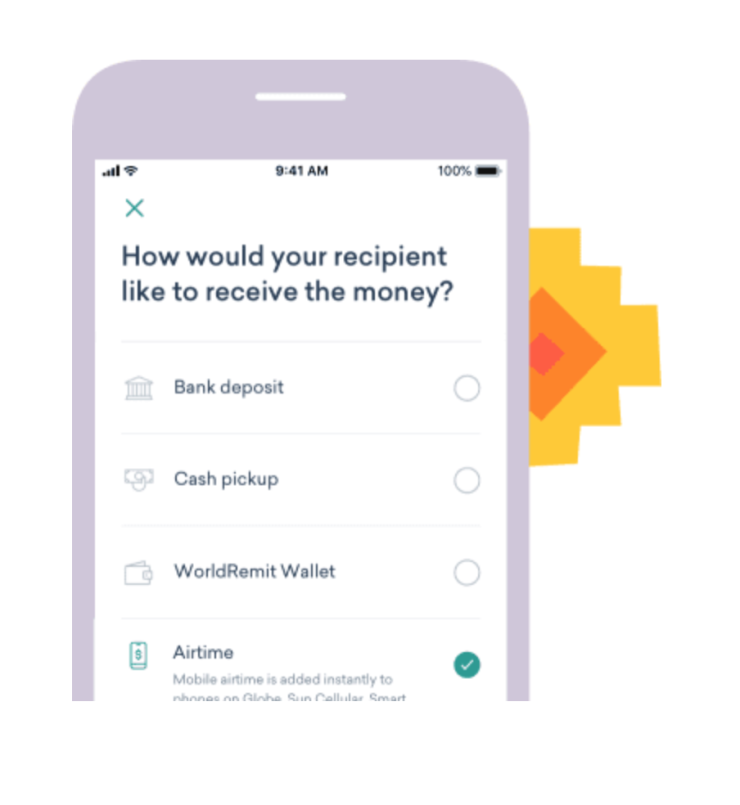

- Mobile product

- Trustworthiness & Reliability

- Business product offering

- Product coverage and service

- Customer feedback and satisfaction

- Customer help and assistance

- Pricing transparency