Revolut Money Transfer Review - Money Transfer Costs and FXcompared’s rating

Rating based on expert reviews by FXcompared

Andrew Rosenbaum

Senior Content Specialist

Andrew Rosenbaum has been a financial journalist for more than 15 years. He has worked for Euromoney, Institutional Investor, Time magazine, MSN Money and the Wall Street Journal before joining FXcompared.com. He is currently authoring a number of ICO whitepapers for cryptocurrency projects.

Founded in 2015 by Nikolay Storonsky, a former Lehman Bros banker, Revolut allows you to send fast, free and secure money transfers to bank accounts in over 160 countries while saving you money by using the real exchange rate.

Revolut has added new offerings including business accounts, loans, loyalty offers, mobile phone insurance, a bill splitting feature, a subscription "Premium" account, a chatbot, and more. The company offers a prepaid debit card, commission-free stock trading, and cryptocurrency exchange facilities, as well as money transfers.

Revolut is regulated by the Financial Conduct Authority, and in 2018 it secured a European banking licence. Below is a comprehensive review of Revolut's services and international money transfer offering.

Contents

- How much does it cost to use Revolut to transfer money?

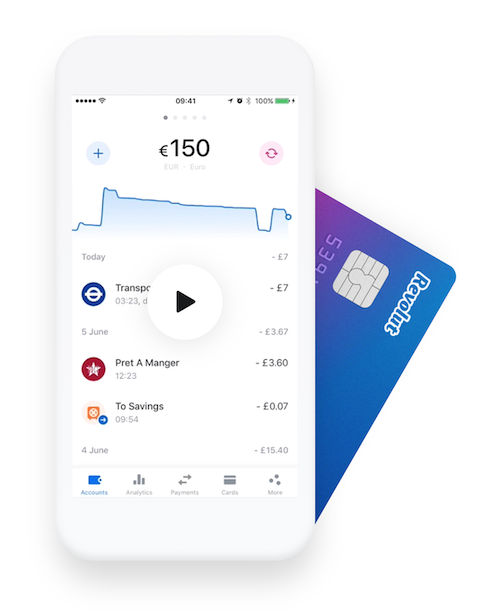

- How easy is Revolut to use?

- How does Revolut's mobile product compare?

- How trustworthy and reliable is Revolut?

- A review of Revolut's Business Account

- Revolut's product coverage and service

- What feedback have customers given about Revolut?

- Revolut's options for customer help and assistance

- How transparent is Revolut on pricing?