FXcompared

Money Transfer Report 2018

Part 2

Digital Currency Business Models Evolve

Other Areas of Growth in International Payments

Digital Currency Business Models Evolve

The future of digital currencies is still under heated debate, and most international payment companies are reluctant to integrate them until the risks lessen. More and more payment companies are betting on more widespread adoption, especially given the massive rise in interest since late 2017 when bitcoin surged. Over the past year, Abra has become a bitcoin wallet, and Revolut announced that they would let users of their multicurrency accounts hold bitcoin alongside fiat currencies.

The payments industry is in closer agreement when it comes to the potential growth and usefulness of blockchain, the digital ledger technology that underlies cryptocurrencies. One of the largest blockchain companies, California-based Ripple, signed up over 100 financial institutions to use its technology for cross-border payments. All of the use cases of digital currencies and blockchain remain unclear but, while funding remains available, companies will work to improve the current system. The need to still add an additional (potentially volatile) currency to the value chain remains an issue but as liquidity in these currencies increases, this may fall.

Abra CEO Bill Barhydt believes that bitcoin and blockchain will be instrumental to the future of international payments, because these technologies allow money to move nearly instantaneously. That’s why, as mentioned above, Abra has changed the main focus of its app from buying and holding foreign currencies and enabling remittances to facilitating bitcoin transactions. The app has served as an external bitcoin wallet since last April, and it provides one of the easiest ways for consumers to buy bitcoin.

Abra is most popular with Gen Xers and Baby Boomers (aged 40-60) who want to diversify their investments. They can use Abra to speculate on bitcoin, hold and trade fiat currencies, and transfer funds. Going forward, Abra intends to offer more ways for consumers to load bitcoin onto their wallet, such as through other alternative currencies like ethereum.

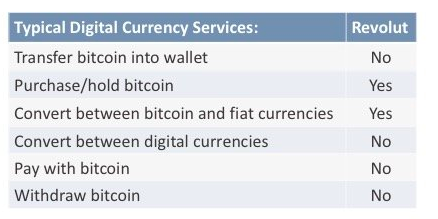

Revolut Takes a First Step

By adding bitcoin to its supported currencies, Revolut hopes to expand its customer base--either directly, by attracting bitcoin fans, or indirectly, through the enhanced image and additional publicity such an innovative capability tends to provide. Rather than jumping in all at once, the company is following a careful strategy. Users can convert fiat currencies into bitcoin inside their Revolut account and then hold it, but they cannot yet pay for goods with bitcoin or transfer bitcoin out of their Revolut account. This graphic compares Revolut’s bitcoin capabilities with those of typical digital currency services:

Revolut’s cautious approach makes sense in light of the history of bitcoin acceptance in the payments industry. While companies like Square and Stripe have achieved success with bitcoin and helped boost consumer adoption, other companies that embraced bitcoin early on have reluctantly decided to withdraw support:

TransferWise co-founder and CEO Kristo Kaarman attributed his company’s decision to pull out of bitcoin in 2013 to provider banks’ discomfort with the cryptocurrency’s lack of clear rules. In addition, the anonymity of bitcoin buyers and sellers makes it an attractive medium for illegal activity like money laundering. “In many respects it breaks our heart to have taken this step (we’re a firm that champions financial innovation after all), but we know our banking providers are not comfortable with Bitcoin and want payments to these firms restricted,” wrote Kaarman in a blog post published on TransferWise’s web site. He labeled the move “a shame” because of the potential for digital currencies to solve some of the “absurdities” of the traditional banking system by reducing the number of intermediaries who take a cut of the transaction.

The consumer finance company Circle was launched in 2013 as a bitcoin-based money transfer platform. But three years later it stopped letting users buy and sell bitcoin in order to direct more resources towards its social payments capabilities. While transactions now have to be denominated in fiat currencies, Circle still uses bitcoin for settlements on the back end.

Ripple Aims to Replace the Traditional Payments Infrastructure

Ripple is well-poised to capitalize on the recognized potential of blockchain technology and the increase in the number of organizations and governments that have warmed up to the idea of blockchain-based money transfers. As of early 2018, its token XRP had just edged out Ethereum to become the second-most-valuable cryptocurrency with a market capitalization of nearly £66 billion ($89b). It has set an ambitious goal of eventually replacing the backbone of the payments infrastructure, namely the Society for Worldwide Interbank Telecommunication (SWIFT). Founded in 1973 to establish international process and standards for financial transactions, the SWIFT organization allows over 11,000 institutions in more than 200 countries and territories to send and receive payment orders among themselves.

Whereas interbank transactions via SWIFT can take about three days, Ripple’s network, which is based on the rapid purchase and sale of its XRP digital currency, can complete cross-border payments within 10-15 seconds. Advantages like this one have attracted customers such as France’s Crédit Agricole, Brazil’s Bexs Banco, Amex, and Santander. Ripple CEO Brad Garlinghouse considers his company distinct from those that use blockchain simply as a buzzword to generate hype instead of a means to solve real-world problems: “This is not a science experiment, it is about using real money for real customers. There are a lot of blockchain tourists out there who are kicking the tyres, but we are well beyond that.”

Garlinghouse claims that the current system is beset with errors and inefficiencies, which Ripple’s system could rectify. For example, some Ripple customers are piloting xRapid, the XRP liquidity solution, to make payments into emerging markets, which traditionally require multiple currency traders and pre-funded nostro accounts (local currency accounts held by another bank) in the destination country. xRapid bypasses the need for intermediaries and nostro accounts, thus dramatically reducing the cost of money transfers. While happy with the interest in his company so far, Garlinghouse recognizes that it takes time for revolutionary ways of doing things to gain traction. “It’s safe to say that we have to crawl before we walk before we run. This is uncharted territory for banks and payment providers and it’s going to take time before you see broad adoption of digital assets solving this multi-trillion dollar opportunity.”

Other Areas of Growth in International Payments

Online Marketplaces Still Offer Big Opportunities

Global e-commerce sales total an estimated £1.5trn ($2trn), and payment companies are heavily targeting online marketplaces in order to get their piece of the pie. Payoneer raised £133m ($180m) last year specifically to serve online marketplaces, World First is experiencing unprecedented growth, and Vantiv’s acquisition of WorldPay for over £7bn ($10bn) will enable it to quickly scale up support for e-commerce. Currencies Direct, OFX, LianLian Pay, and PingPong have also been concentrating their efforts on this sector.

The two biggest incumbents, Amazon and PayPal, continue to dominate, which means that there’s room for disruption by new, lower-cost entrants. The graph below compares the hefty FX margins captured by Amazon, PayPal, and the average US bank to those of typical payment companies. The dominant players are probably getting away with such fees due to brand recognition, ease of use, and lack of awareness of alternatives, but they may not outdo the younger competition so easily once the e-commerce sector starts to catch up with other cross-border products.

For challenger payment companies looking to grow their e-commerce services, China and India continue to offer big opportunities. China hosts the largest e-commerce market in the world. Online sales in 2016 reached £270b ($366b), which is nearly as much as in the US and the UK combined. While growth has slowed a little, top market research firm Euronet predicts that e-commerce will capture almost a quarter of all retail sales in China by 2020. While not yet on par with the US and China, India contains the fastest growing e-commerce market. Analysts predict that sales will reach £47b ($64b) in the next three years.

Asia’s Fintech and Payments Boom

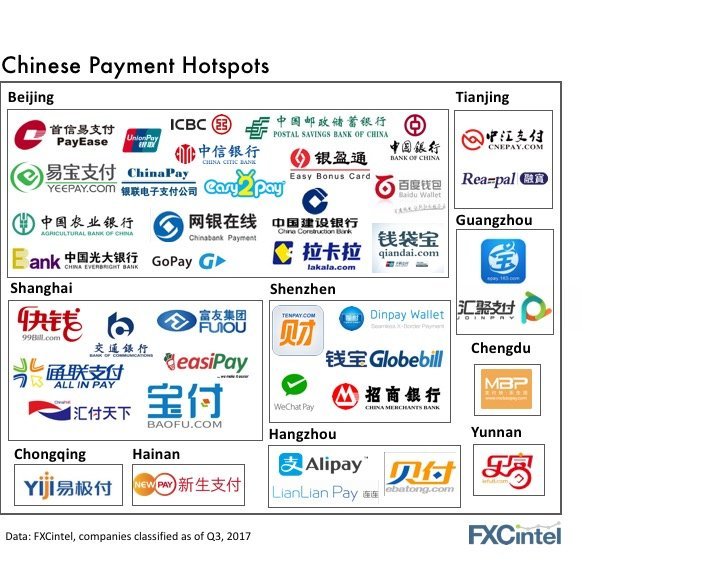

China is full of promise for growing payment companies, but it can be challenging to establish a foothold there because of the country’s complex regulations, stiff price competition, and daunting language barrier. Many companies find that developing a local partnership makes these challenges easier to surmount. Here are the names and locations of the main Chinese players, who might make good strategic partners:

Most of these companies are based in Beijing and Shanghai, but some of the largest, such as Alipay, LianLian Pay, and WeChat Pay, are headquartered in smaller cities. LianLian Pay and WeChat provide great examples of how fruitful a local relationship can be. The former has provided a gateway to companies like World First, eBay, Amazon, and PayPal. And the latter has partnered with Western Union since 2015.

In other Asian countries, innovative fintechs are developing payment products that will influence the rest of the industry. It’s hard to say at this point which country will overtake the others. Here’s a look at four of the most active countries and their payments-focused fintechs:

Singapore’s technological sophistication has attracted substantial capital, most of which has gone into Instarem. The international money transfer startup raised £13m ($18m) in just three years and earned the backing of the Singapore government. Toast, which specializes in remittances to the Philippines, received over £1.5m ($2m) since it was founded in 2015.

According to The World Bank, the Philippines is the third largest remittance recipient after India and China (£24bn or $33bn in 2017) and a fertile breeding ground for bitcoin-related fintechs, such as BuyBitcoin.ph, Bitbit, and Rebit, which are part of Satoshi Citadel Industries. The country has piqued the interest of Ant Financial, which bought a 45 percent stake in the Mynt micro-payment service last year.

South Korea is no stranger to Ant Financial either. The Alibaba affiliate invested £148m ($200m) in KakaoPay last February with the goal of capturing a new market and expanding its business from online payments into offline, banking and financing services. South Korea’s notoriously tech forward economy and fintech-friendly government bode well for this deal, as well as for other aspiring new entrants. In May of last year, the South Korean Ministry of Strategy and Finance announced plans to lower equity capital requirements for fintechs offering FX-related services, including those using bitcoin for remittances.

The Vietnamese government is also taking initiative to support its fintech industry. Last March, Vietnam’s Central Bank formed a steering committee to direct the growth of fintechs. Dramatic growth seems inevitable in a country with more than 90 million people (over half of whom are under 30), increasing internet and smartphone usage, a recent rise in incoming remittances (nearly 10 percent since 2015), and a large proportion of unbanked consumers who would benefit from mobile payment solutions.

The mobile payment provider Momo closed a £21m ($28m) investment round last March, which generated a lot of buzz. Other Vietnamese fintechs that have triggered excitement include VinaPay, an electronic payments company headquartered in Hanoi; Cash2VN, a blockchain-based remittance company; and Moca and Mimo, which focus on both peer-to-peer and merchant mobile payments.

The Evolution of Mobile Apps

As the proliferation of mobile remittance and FX apps continues, the ultimate effect on money transfer companies remains to be seen. Will the more traditional ways that consumers connect to money transfer companies, such as through phone calls to customer service, fall by the wayside. Or will people miss the human touch?

TorFX, a UK-based foreign currency broker that offers money transfer services, is betting on people over technology. The company’s marketing approach focuses on its exceptional customer service, and it relies on the web mainly just to get potential customers on the phone where the transaction is completed. With an average TrustPilot rating of 5 stars, TorFX’s strategy seems to be working so far. TransferWise is equally well-reviewed, but its customer experience is entirely online, which appeals to users who prefer efficiency over interacting with a person.

It will be interesting to see which of these approaches eventually wins out. Other industries have faced the same dichotomy with various outcomes. For example, the insurance business has moved towards automated brokers, because customers no longer feel the need to speak to a human being to obtain a policy. In contrast, the mortgage industry is still call-heavy, in large part because the financial stakes tend to be higher. Time will tell whether the whole of the FX industry will give into the mobile app trend, or whether--at least for the largest transactions--customers are more likely to entrust their hard-earned money with a fellow human.

Conclusion

In the past year, the money transfer industry has continued to undergo dramatic changes. To remain competitive and address additional customer pain points, payment companies have diversified their product sets and services, venturing further into the territory of traditional financial institutions. As the offerings of various industry players overlap with each other more and more, thus heightening competition, many of them are joining forces to survive and flourish. The increase in consolidation among industry players, as well as major investments by VC and PE firms into younger companies, is expected to drive continued global expansion. E-commerce, especially in China and India, remains a big growth opportunity, and Asia as a whole offers a lot of promise for fintech startups. Many questions remain, such as on the future of cryptocurrencies and whether mobile payments will fully replace the human touch, but one thing that’s always certain when it comes to international payments is change.