Remitly Review - Exchange Rates & Fees Calculator and FXcompared’s score

Rating based on expert reviews by FXcompared

Daniel Webber

Founder & CEO

Daniel is Founder and CEO and has 20 years of experience in the international finance world focusing on cross-border payments, technology and the property sectors. Daniel is widely quoted as an expert within the money transfer industry including by The Economist, The Wall Street Journal, Reuters, CNBC and Bloomberg. Daniel is passionate about helping consumers and businesses find the best and most efficient ways to transfer money internationally.

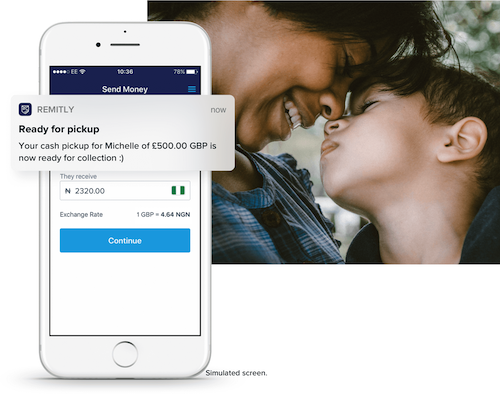

About Remitly

Founded in 2012, the online and mobile payment service company Remitly provides international money transfers. The company serves clients in the UK and across the Eurozone, as well as in the USA, Canada and Australia. Remitly provides fast, secure digital money transfers to more than 40 countries, and is fully authorised to send international money transfers across all US states, and throughout Canada, except for Quebec. Services are available in several languages, including English, Polish, Spanish and German, and can be accessed via any device connected to the internet, or via the Remitly app, which is available for any smartphone or tablet. In February 2020, Remitly launched Passbook, a mobile banking service designed for immigrant communities.