SWIFT codes, also known as BIC codes, are codes that are used to identify banks when you are sending money overseas. You might be asked for a SWIFT code if you are looking to send money to another country through your bank or chosen money transfer company.

So what does a SWIFT code look like? When do you use it? And how can you find it? We’ve answered all of these questions in our guide below.

Contents:

- What is a SWIFT code?

- What does a SWIFT code look like?

- When do I need a SWIFT code?

- Is a SWIFT code different from a BIC code?

- What's the difference between a SWIFT code and an IBAN number?

- How can I find a SWIFT code?

- Do I need a SWIFT code for international money transfers?

- What other details do I need to make or receive an international bank transfer?

- How to make an international money transfer

What is a SWIFT code?

Think of a SWIFT code like an ID number for a bank or financial institution. It’s an 8-11 character code built using information about your bank, the country it is in, its headquarters location and your particular branch.

SWIFT codes are named after the Society for Worldwide Interbank Financial Telemcommunication system (SWIFT), a messaging network that connects banks from different countries and allows them to send money.

The SWIFT system connects more than 11,000 banks, financial institutions and corporations across more than 200 countries and territories. That makes it the biggest international money transfer network worldwide, so chances are you’ll be using it if you want to transfer money overseas.

What does a SWIFT code look like?

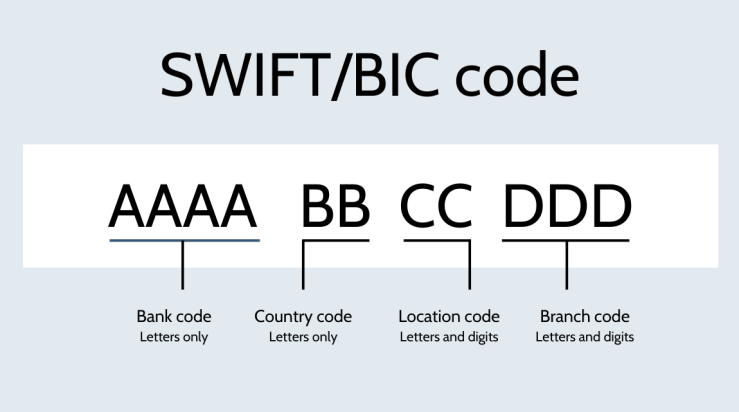

A SWIFT code is formatted like this:

- Bank code: A four digit code made up of letters, usually the first letters of a bank’s name.

- Country code: These two letters represent the bank the country is in.

- Location code: Two characters showing where the bank’s head office is located.

- Branch code: Three digits that specify a particular branch.

Here is a visual representation below:

If we were to use Monzo as an example, the SWIFT code would be formulated as follows:

- Monzo’s bank code takes its first four letters: MONZ

- Monzo is based in the UK, which has the country code: GB

- Monzo’s head office is registered at Broadwalk House, 5 Appold Street, which gives a location code: 2L

- The branch code is obviously dependent on your specific branch, so we’ll leave this blank for now: XXX

The complete Monzo SWIFT code would therefore be: MONZGB2LXXX.

When do I need a SWIFT code?

You’ll need to provide the SWIFT code of the recipient whenever you are looking to send money abroad. Perhaps you’re sending money to a friend in another country or paying a business for a service; either way, you’ll need to provide a SWIFT code to identify the receiving bank.

Sending money abroad can occur not just through banks, but also through international money transfer companies, who are often able to help you complete a transaction from one country to another with a number of different payout methods (bank account, cash, debit card etc).

Examples of these money transfer providers include Western Union, Wise, Remitly and WorldRemit – you can find out more about some of the most well-known providers in our money transfer company reviews section.

Is a SWIFT code different from a BIC code?

Technically yes, but the terms are often used interchangeably.

According to SWIFT, BIC stands for Business Identifier Code (BIC), and so it can technically be applied to both financial and non-financial institutions. However, a number of money transfer companies also refer to it as a Bank Identifier Code.

At the end of the day, if you’re looking to make an international money transfer and are asked for a BIC code instead of a SWIFT code, you’ll be providing the same number.

What’s the difference between a SWIFT code and an IBAN number?

Sometimes, though not for every transaction, you’ll need to give an International Bank Account Number (IBAN) in addition to the SWIFT code.

While the SWIFT code identifies your bank, the IBAN is unique to your specific account and can be used alongside your regular account number and sort code to make international payments.

The IBAN consists of up to 34 letters and can vary in length depending on the country where the bank account is situated. For example, in the UK, IBANs consist of 22 digits and include the country code, check digits and bank code, in addition to your sort code and bank account number.

IBANS are most frequently used by European countries (e.g. for SEPA credit transfers), though there are also several countries outside of the continent that require an IBAN for international money transfers.

You can find out whether an IBAN is mandatory for international payments by checking the IBAN registry. If your country is a registered user of IBAN, you’ll need to provide this information in order to make an international money transfer.

TLDR: The SWIFT code identifies your bank, the IBAN identifies the specific account.

How can I find a SWIFT code?

Most banks should provide this code in your customer account details. You can check your bank statement, or it may be available via your bank’s mobile apps or their website.

If in doubt, you’ll be able to request your SWIFT code at your bank branch.

Do I need a SWIFT code for international money transfers?

While you may not always be asked for an IBAN number to make an international bank transfer, you will almost always need to provide the recipient’s SWIFT code. This is so that your money transfer can be routed correctly.

Note that you are usually required to provide the SWIFT code for the bank code receiving your money, rather than the one transferring it. However, in some instances you may be required to provide the SWIFT code for both your bank and your recipient’s so that the overseas bank is able to identify the sender, meaning it is good to have this handy just in case.

What other details do I need to make or receive an international bank transfer?

As we cover in our wider money transfer guide, the exact details you need to make a transfer will depend on the country where you will be sending your money. However, usually you will need to provide some combination or all of the following items for your chosen recipient:

- Full name and address

- Bank account number

- Bank’s address

- Swift/BIC Code

- An IBAN

- A National Clearing Code (which some banks use when their customers don’t have an IBAN)

How to make an international money transfer

Making an international money transfer through the SWIFT system may take longer and require more details than a domestic transfer. However, with the right money transfer provider to guide you through the process, it can be much easier, more secure and less costly.

Finding the right provider for your transfer is simple. Just head to FXcompared’s homepage and use our money transfer comparison tool, which compares the best providers in seconds. Or for more tips and advice about sending money overseas, check out our guides below.

- What to think about when comparing money transfer companies

- Comparing the best exchange rates

- What are the rules about transferring money to my chosen country?

- What are the factors affecting my money transfer?

- The best money transfer apps