What are ACH transfers?

An ACH transfer refers to any electronic money transfer between banks that involves the Automated Clearing House Network. Created by the Federal Reserve Bank, this network is one of the largest payment systems in the world. It processes 24 billion transactions worth over $41 trillion every year. A nonprofit organization called NACHA (National Automated Clearinghouse Association), which represents 10,000 financial institutions in the US, manages and regulates the network.

The clearinghouse does just what it sounds like. It clears transactions in large batches on behalf of its participating banks, which means that the banks collect a bunch of ACH transactions throughout the day and then send them to ACH to be processed. So the ACH serves as a money transfer middleman.

What are ACH transfers used for?

ACH transfers can benefit consumers and businesses alike. There are two main types of ACH transfers, both of which you’ve probably encountered in your everyday lives:

Direct Deposit via ACH

Many employees in the US receive their salaries and expense reimbursements through an ACH Direct Deposit. Government benefits and tax refunds can also be delivered through this method. Basically, any time a business or the US government uses the ACH Network to put money into your bank account, that’s considered a Direct Deposit via ACH.

Direct Payment via ACH

Direct Payment takes place when individuals or organizations make a recurring or one-time payment, such as to a family member or to a vendor, through the ACH Network. Direct Payments are further subdivided into ACH credit and ACH debit transactions. The former involves funds being pushed into an account, like when you ask your bank to send money to your phone company to pay a bill. The latter involves funds being pulled from an account, like when you agree to let your car company automatically withdraw a monthly loan payment from your checking account.

How much do ACH transfers cost?

ACH transfers are typically inexpensive or free, especially if you’re on the receiving end. Senders, including those who use a peer-to-peer payment app, usually pay less than $1 USD per transaction.

How long do ACH transfers take?

NACHA Operating Rules specify that ACH credits must settle (i.e., be complete and available) within one to two business days, and ACH debits must settle on the next business day. However, NACHA is in the middle of a multi-year plan to speed up its service even further by offering banks two additional daily windows for batch processing. Beginning this month, it will enable same-day processing of almost any transaction for an extra fee.

What’s the difference between ACH and wire transfers?

ACH and wire transfers are two of the oldest and most commonly used methods for safely sending funds between US banks; however, there are important differences to be aware of when deciding between the two.

The most striking difference relates to cost. Wire transfers involve a direct bank-to-bank connection, so there’s no middleman to do the bulk of the work. In addition, unlike ACH transfers, wire transfers are not fully automated. A bank employee usually reviews wire transfers before clearing them, and sometimes additional phone or email follow-up with customers is required for verification purposes. As a result of all of this extra manpower, banks charge dramatically higher fees for both sending and receiving wired funds. At the top US banks, wire transfer fees typically fall between $35 and $50 for outbound transfers and around $15 to $25 for inbound transfers.

So why would anyone choose a wire over ACH? Traditionally, the answer had a lot to do with speed. Wires are lone wolves. They require no waiting period while banks collect batches of transactions and await the ACH processing window, so they’ve tended to be much faster. Domestic wire transfers usually get sent within one business day and often settle on the same day. International wire transfers can take a bit longer, but they’re still pretty swift. However, now that NACHA has launched its Same Day ACH, the speed gap between the two payment methods is narrowing.

Can the ACH Network be used for international money transfers?

The Automated Clearing House handles transactions for US banks; however, there are corresponding clearinghouses in other regions of the world. For example, the EU’s system for clearing bulk payments on behalf of its banks is known as the Single Euro Payments Area (SEPA). It represents 35 countries and aims to make cross-border payments as simple as domestic ones. Australia’s electronic payment system is called Direct Entry. It processes one-third of the 20 million non-cash payments made by Australian businesses and consumers each business day.

No single guiding standard exists for transferring money internationally via clearinghouses like these, which can make things complicated. Fortunately, there are online money transfer services that simplify things for you. They can link to local clearinghouse networks and deal with the particulars of foreign countries’ banking specifications and regulations, so you don’t have to worry about the details.

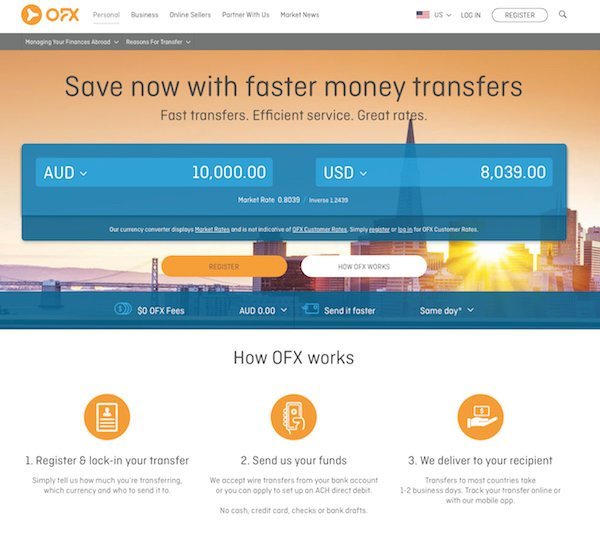

For transfers initiated in the US, you can use the ACH Network to submit funds from your bank account to money transfer providers like OFX, Transferwise, PayPal, and PayPal’s mobile payment app Venmo. Then these providers will forward the funds to the international destination you specify using their connections in the receiving country. Relying on modern online platforms for cross-border payments instead of traditional financial institutions like banks, which typically charge higher fees, can save you a lot of time and money.

How do I set up an ACH transfer?

Before transferring funds through the ACH Network, businesses usually need to set up an ACH merchant account with their bank or money transfer service. This process is similar to establishing an account for credit or debit card processing. It typically involves answering general questions about your business, agreeing to a credit check, and submitting info on the checking account that you want to be linked to the merchant account.

Consumers have it easier. They usually just need to provide bank account info (i.e., name, account number, and ABA routing number) for the sender and recipient. Peer-to-peer payment services may even just ask for the recipient’s email or cell phone number, thus simplifying the process even further. All of this can be done quickly and conveniently online, so feel free to jump right in!