The team at FXcompared recently had the chance to interview the founders of innovative money transfer company, Circle.

Founded in 2013 and headquartered in Boston, Massachusetts, Circle aims to bring the intuitive user experience enabled by modern technology to the sometimes archaic money transfer industry. Circle founders Jeremy Allaire and Sean Neville recognized a lapse in money transfer technology and created Circle as a response to this issue. Circle is designed with the user in mind, making money transfer as easy as text messaging.

Circle initially embraced bitcoin technology, and allowed users to both buy and sell bitcoin directly through the Circle app. In December 2016, Circle announced the elimination of direct bitcoin buying and selling through the app and a new bitcoin exchange partnership with Coinbase. Read our interview below with Jeremy and Sean to learn more about Circle’s beginnings, the future of money transfer and to find out what led Circle away from bitcoin.

CEO Interview: Jeremy Allaire & Sean Neville Talk Circle

Jeremy Allaire

Sean Neville

What led you to found Circle?

In early 2013, we saw a confluence of trends and major technologies emerging that led us to believe that now was the time to create a consumer internet company focused on changing how money worked. We saw that it was becoming possible to make money work for consumers the same way that communications and information sharing work for consumers on the internet -- instant, global, free, fun, and open. Specifically, the birth of digital currency and blockchain technology, the application of machine learning and artificial intelligence to financial risk decisions, the advent of smartphones as payment instruments and the availability of global, at-scale cloud computing platforms make it possible to provide a new kind of universal spending account.

What do you like most about being part of Circle?

At this stage in our careers, we’re really only interested in working on really large and complex problems that have the potential to really change how the world works. Circle gives us such a platform, and in turn that attracts a highly intelligent and motivated group of collaborators to work on this with us.

What three things do you think sets Circle apart from its competitors?

Circle is the only social payment app that works across currencies, with the lowest exchange rates and costs to consumers, and with open connectivity to other digital wallets through blockchain technology. Plus, it’s highly engaging and enjoyable when payments and messages are merged, helping define a new experience for p2p payments.

Your firm started with a focus on bitcoin. What drove your decision to change this focus?

We didn’t start with a focus on bitcoin, we started with a focus on building an open, global social payment service. Blockchain technology and bitcoin specifically is important infrastructure in the background for making that possible. Before we could offer a product to mainstream customers using their local currencies (USD, GBP, EUR, RMB, etc.) we chose to offer the service with bitcoin instead of waiting the 2 to 2.5 years to get all of the government licenses we needed to operate with native national currencies. As soon as we launched our mainstream product (15 months ago), bitcoin was very much in the background. Some early adopters continued to rely on Circle as a way to buy and sell bitcoin using credit card and banking rails in the apps, which carried risk related to network rules and was not our intended use case or audience -- we employ bitcoin and the bitcoin network as a settlement layer between digital wallets, not a front and center currency for consumers. We recently eliminated that buy and sell option in the apps, though we still buy and sell directly to support our own FX liquidity and reserves. In the apps, we point customers to companies such as Coinbase whose core business is being a bitcoin exchange. Through our recently announced Spark APIs, we continue to use bitcoin behind the scenes to settle a variety of international transactions between Circle and trusted counterparties.

The international payments industry is currently a hot part of the fintech space. What do you think is driving this?

I think many people realize that payments in general, and global payments in particular, represents an area that is ripe for disruption and change, where both the customer experience and the economics leave a lot to be desired. In our view, the entire category of cross border payments, at least for consumers, will disappear in the coming years. As we often like to ask, when is the last time you sent a cross border email or SMS or had an international web browsing session? The internet doesn’t care about borders and boundaries, and as financial settlement moves to digital native assets and tokens, we can deliver a consumer experience and economics that approximates the experience we have today with internet-based information sharing and communications.

The money transfer world has witnessed rapid changes with the advancement of technology in the past few years. More consumers are interested in bank alternatives with lower fees. What changes have Circle been most excited by?

The growth in social payments as a category, led first by Chinese internet giants. This to us is the early emergence of a major new category of consumer internet service which we think will ultimately be a starting point for other financial products and services. Obviously, the advent of blockchain technology -- both public blockchains such as the bitcoin network and ethereum, as well as more general purpose distributed ledger runtimes such as Fabric and Corda -- which makes many use cases and scenarios possible that haven’t been before. In general the fact that younger consumers are seeking alternative providers for their financial products is suggesting that major global and national finance franchises will be up for grabs globally in the coming decade.

Circle: An Overview of the Circle App

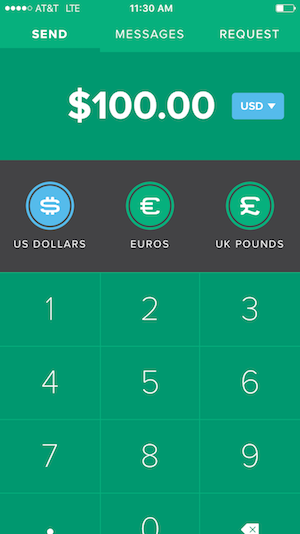

Send Money in Multiple Currencies

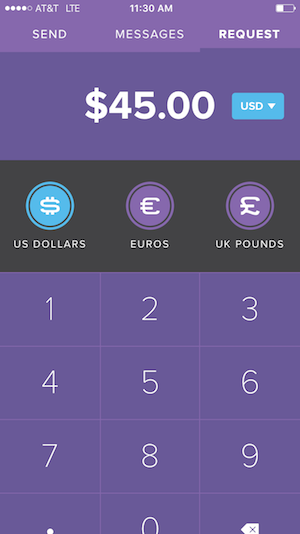

Request Money in Multiple Currencies

Unlike similar payment apps, such as Venmo, Circle allows for international payments. The above screenshots show that transferring money in different currencies is easy to set up, with just the click of a button.

A quick glance at the Circle app reveals a user-friendly interface, and setting up the app is fast and simple. The simplicity of the Circle app is partly what draws users, unlike many international money transfer apps that require multiple steps before money transfer, registering with Circle is fast, easy and convenient. Some more unique features of the app include:

- Messaging capabilities within the app

- Payments can be made in USD, Euro and pounds

- Debit cards can be scanned, allowing fast and easy sign-up

After test driving Circle's app, the team at FXcompared looks forward to seeing what technology Circle debuts in the future.

Interested in learning more about international money transfer apps? Check out our review of 15 different apps here.

Oanda CEO Vatsa Narasimha On the Future of Money Transfer

Mike Massaro, Flywire CEO Interview - On Money Transfers and Receivable Payments