2016 has been a good year for digital currencies. The price of one bitcoin has risen from $435 at the start of the year to just over $700 today, while currencies like Ethereum have partnered with tech heavyweights such as Microsoft.

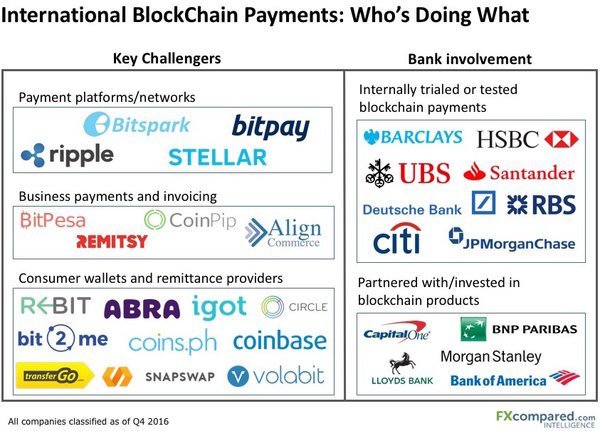

Here's an overview of blockchain-based international payment providers in 2016:

So far challenger companies have led the way in terms of usable services. Bank involvement meanwhile has typically been limited to theoretical or internal testing, as they place their bets across sector. This may change as the industry continues to develop, and banks move from internal testing to potential beta product tests with actual customers.

One of the large and still unanswered questions surrounding the adoption of blockchain products remains the level of regulation they will be held to. This factor alone may be a determining one in the continued development of the blockchain ecosystem.

Money Transfer in 2016: De-Risking

One of the big trends in the international payments industry (and perhaps one of the reasons banks have been hesitant to jump into digital currencies) is the "de-risking" movement.

As we detailed in our comprehensive report about the state of money transfer, small brokers have found it increasingly difficult to maintain bank accounts due to bank fears over anti-money laundering and know-your-customer violations.

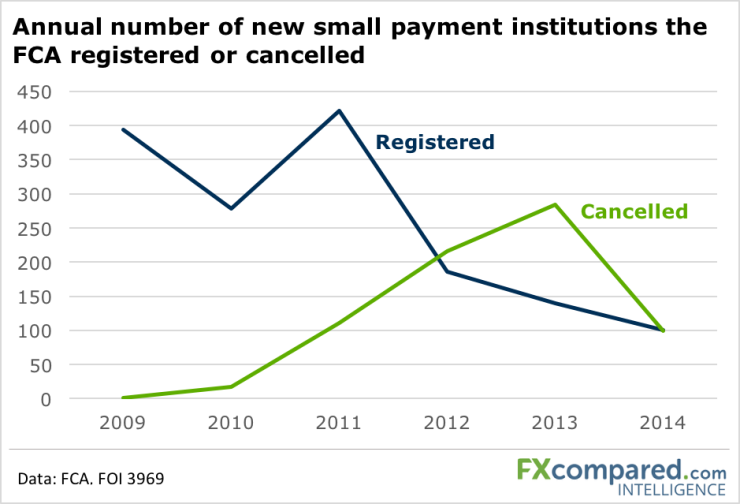

In the U.K., over 700 money transfer providers have had their operating licenses revoked since 2010. 94.5% of these were small payment institutions.

Who's Using FXcompared Data APIs

FXcompared's International Money Transfer Index (IMTI) is the definitive source on global transfer rates. The index is available via API to integrate into currency converters and savings calculators.

We're pleased to count GAIN Capital's newly launched ForeignExchange.com money transfer service as a user of our IMTI API data, which provides accurate, up-to-date savings comparisons for GAIN's customers.

Want Insights Like These In Your Inbox?

Our weekly newsletter is packed with insights into the FX, international payments, and money transfer industry.