OFX US Review - Money Transfer Costs and FXcompared’s rating

Rating based on expert reviews by FXcompared

Daniel Webber

Founder & CEO

Daniel is Founder and CEO and has 20 years of experience in the international finance world focusing on cross-border payments, technology and the property sectors. Daniel is widely quoted as an expert within the money transfer industry including by The Economist, The Wall Street Journal, Reuters, CNBC and Bloomberg. Daniel is passionate about helping consumers and businesses find the best and most efficient ways to transfer money internationally.

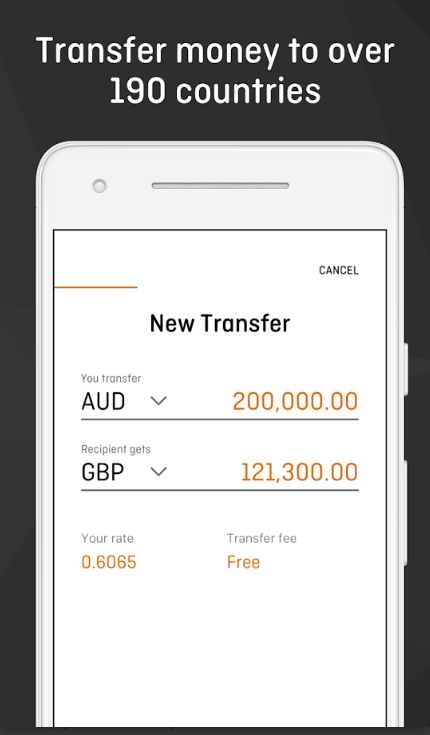

About OFX US

Launched in 1998, OFX US, formerly USForex in the US, is one of the world’s leading services for international payments and online currency exchange. The company serves both corporate clients and individuals in the US, is regulated by FinCEN, and offers competitive foreign exchange rates combined with a high level of customer service available 24/7.

OFX US is an internationally respected money transfer service offering high exchange rates and high-quality round-the-clock customer service.