InstaReM Review - Money Transfer Costs and FXcompared’s rating

Rating based on expert reviews by FXcompared

Daniel Webber

Founder & CEO

Daniel is Founder and CEO and has 20 years of experience in the international finance world focusing on cross-border payments, technology and the property sectors. Daniel is widely quoted as an expert within the money transfer industry including by The Economist, The Wall Street Journal, Reuters, CNBC and Bloomberg. Daniel is passionate about helping consumers and businesses find the best and most efficient ways to transfer money internationally.

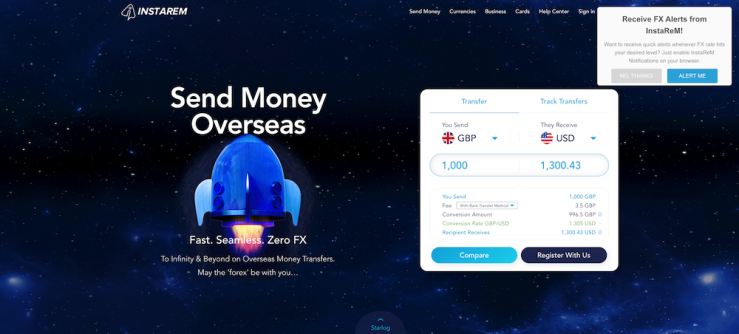

InstaReM Review

InstaReM is a relatively new international money transfer company that offers extremely competitive exchange rates and low transfer fees. The platform provides quick money transfers, which usually take no more than one day. It also offers a range of specialised services for small and medium-sized businesses, and loyalty points are offered upon registration, recommendations and with each transaction.

Despite the fact that InstaReM was launched recently, in 2015 (it was co-founded by fintech entrepreneurs Prajit Nanu and Michael Bermingham), the client base has grown to 35,000 customers who use the platform every month. The company has a unique payment network in Asia and processes more than half a million transactions per year. Headquartered in Singapore, it currently has a team of more than 100 employees worldwide and is a licensed service provider in Australia, Malaysia, Singapore, India, Canada, the US, the UK and Hong Kong.