Dahabshiil Money Transfer Review - Money Transfer Costs and FXcompared’s rating

Rating based on expert reviews by FXcompared

Daniel Webber

Founder & CEO

Daniel is Founder and CEO and has 20 years of experience in the international finance world focusing on cross-border payments, technology and the property sectors. Daniel is widely quoted as an expert within the money transfer industry including by The Economist, The Wall Street Journal, Reuters, CNBC and Bloomberg. Daniel is passionate about helping consumers and businesses find the best and most efficient ways to transfer money internationally.

Contents

- About Dahabshiil

- Dahabshiil Transfer Fees and Costs

- Usability

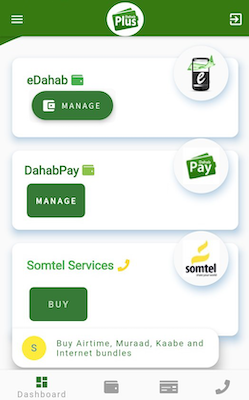

- Mobile product

- Trustworthiness & Reliability

- Business product offering

- Product Coverage & Service

- Customer Feedback & Satisfaction

- Customer Help & Assistance

- Pricing Transparency

- Alternatives to Dahabshiil

- FAQs

About Dahabshiil

Founded in 1970 as the African version of Western Union, Dahabshiil is Africa’s largest international money transfer business and currently has five offices around the world — in Hargeisa, the capital of Somaliland (the breakaway province of Somalia), Dubai, London, Modagishu and Canada.

Translated from Somali, the ‘gold recovery factory’ was named ‘Dahabshiil’ as a new money transfer company that helps migrants send money to friends and relatives in neighbouring East African countries. It became the first cross-border payment company to receive full permission from the prestigious UK Financial Conduct Authority in 2010.

The company provides money transfers and banking services to both individuals and legal entities, as well as international organisations. The latter include the World Bank, the United Nations, Save the Children and Oxfam — these depend on Dahabshiil to provide payment services to its employees, its partner NGOs, its contractors and government agencies.

By providing unrivalled exchange rates and transfer fees for individuals and legal entities, it maintains a leading position in Africa as a fully compatible and secure business for international payments.