How Does Xoom Work?

Xoom is an international money transfer website and mobile app that was acquired by PayPal in 2015. It enables users to send money from their bank accounts or credit/debit cards to friends and family in 64 countries. Funds can either be deposited in the recipient’s bank account or picked up locally as cash. In some cases, the cash can even be delivered to the recipient’s home. Most money transfers become available in two days or less.

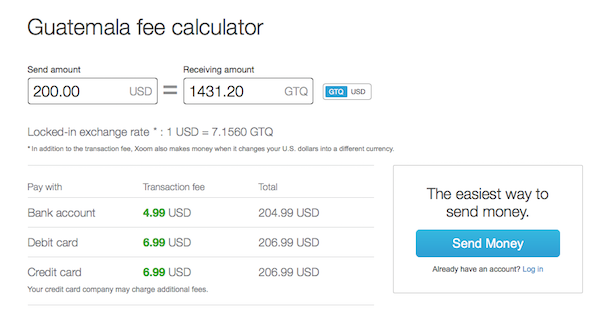

There’s a limit of $10,000 USD per transaction, and exchange rates vary depending on how much is transferred. For example, someone sending money to India would get a better exchange rate if they transferred $2,000 USD or more. Transfer fees depend on where the money is going, how much is being transferred, and what funding method is used. Its fees tend to be on the higher side for international money transfer apps. Fortunately, Xoom provides a very streamlined and user-friendly calculator for determining exchange rates and fees, so all costs are transparent to the consumer.

Here’s an example of a $200 transfer from the US to Guatemala:

The Xoom platform also lets people pay major bills, such as phone and electric bills (e.g., from TelMex in Mexico), for loved ones abroad. All that’s needed is an account number, and Xoom will display the amount that’s due. Most bills get paid right away. And Xoom users can instantly reload prepaid mobile phones simply by entering the recipient’s phone number. These features eliminate the hassle of carrying around cash and waiting in long lines. Other features of Xoom include a money request option, so that users can be alerted when their family members need money, and a money-back guarantee if there are problems with the transfer.

How does Xoom integrate with PayPal?

About a year after PayPal acquired Xoom, it integrated the two platforms so that a user’s credentials and financial information from PayPal automatically carry over to Xoom’s web site. (A PayPal account is not required to sign up for Xoom.) Benefits of integration include greater flexibility for senders and recipients alike. In the past, international money transfers through PayPal required that both parties have a PayPal account, and funds only went from one PayPal account to the other. Now, with Xoom’s options of receiving transfers directly into a bank account or as cash, the flow of money is less restricted. This improvement is a particular relief to recipients who need emergency cash.

PayPal CEO Dan Schulman sees Xoom as another step in the parent company’s efforts to democratize financial services. PayPal’s highly popular peer-to-peer payment app, Venmo, as well as its newly acquired bill payment company, Tio Networks, also play a big part in meeting this goal. According to Schulman, “Two billion people around the world and maybe 70 million or so people in the US are underserved by traditional financial institutions. They stand in line for sometimes over an hour just to cash a check. It costs 2% to 5%. Then when you get cash, you really can’t do much with it. It could cost you $8 to $10 to take that cash that you just paid 2% to 5% to get, to now transform that into a money order to pay your cable bill. Technology can make the managing and the moving of money much more of a right than a privilege for the affluent.”