Happy new years and welcome back!

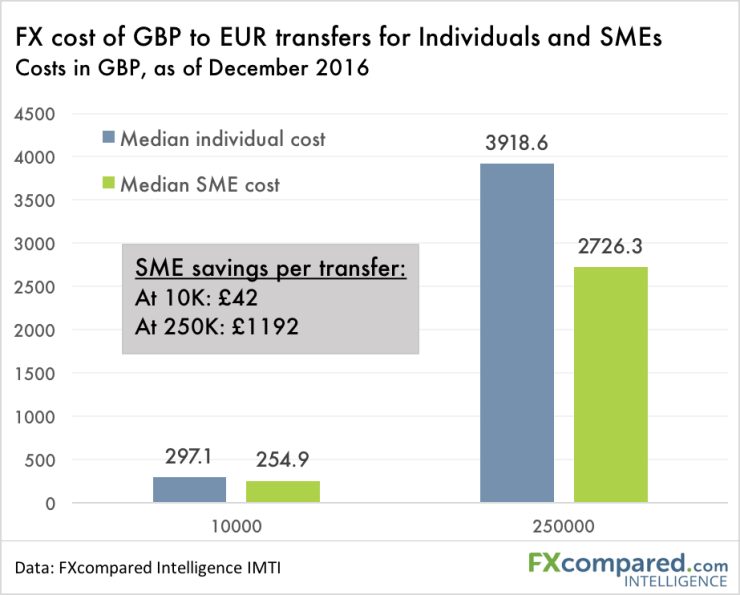

Since the holidays we've been working hard on various initiatives including a new index of commercial bank FX rates to go alongside our International Money Transfer Index (IMTI). Here's a preview of that data:

Important note - this is a small sample of our data, and reflects the median cost of transfers. The full range of SME and Individual pricing is considerably more varied - and available in our monthly IMTI reports.

Circle's evolution from bitcoin

We interviewed Circle co-founders Jeremy Allaire and Sean Neville about their goal to make money transfer as simple as text messaging their recent decision to drop bitcoin from their app. Here's part of that exchange:

FXcompared: Your firm started with a focus on bitcoin. What drove your decision to change this focus?

J.A.: "... Before we could offer a product to mainstream customers using their local currencies (USD, GBP, EUR, RMB, etc.) we chose to offer the service with bitcoin instead of waiting the 2 to 2.5 years to get all of the government licenses we needed to operate with native national currencies. As soon as we launched our mainstream product (15 months ago), bitcoin was very much in the background.

Some early adopters continued to rely on Circle as a way to buy and sell bitcoin using credit card and banking rails in the apps, which carried risk related to network rules and was not our intended use case or audience -- we employ bitcoin and the bitcoin network as a settlement layer between digital wallets, not a front and center currency for consumers. We recently eliminated that buy and sell option in the apps, though we still buy and sell directly to support our own FX liquidity and reserves."

_____

Read the rest of the interview here, including Jeremy and Sean's thoughts on where Circle is headed next, why the payments industry is the place to be, and what technology they are most excited about.

A costly violation

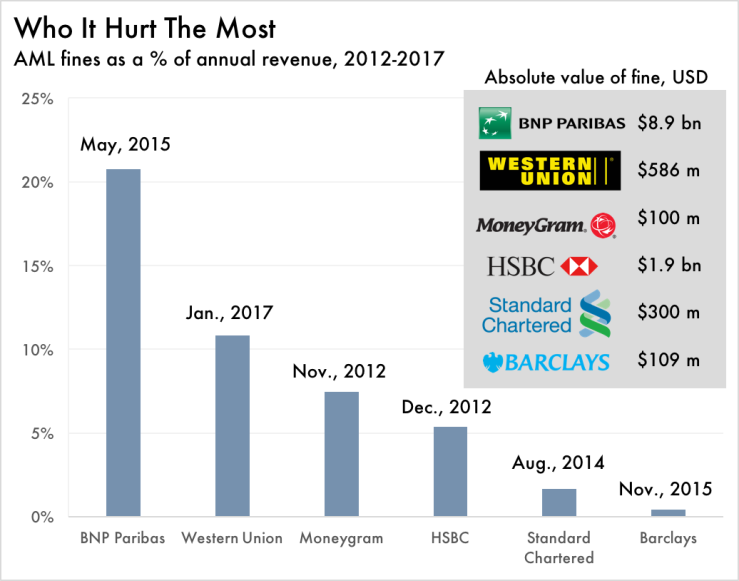

As part of a settlement with the U.S. Department of Justice and Federal Trade Commission, Western Union (WU) has agreed to pay $586 million for violating anti-money laundering (AML) laws.

AML violations have been a consistent problem in the industry, for both brokers and banks. Below we mapped out where WU's recent fine ranks among high-profile AML settlements within the last 5 years:

While AML fines for money transfer providers have been less in absolute terms than for banks, both Western Union and MoneyGram's recent settlements comprise a greater share of their annual revenue than all but BNP Paribas' $8.9 bn violation.

Want Insights Like These In Your Inbox?

Our weekly newsletter is packed with insights into the FX, international payments, and money transfer industry.