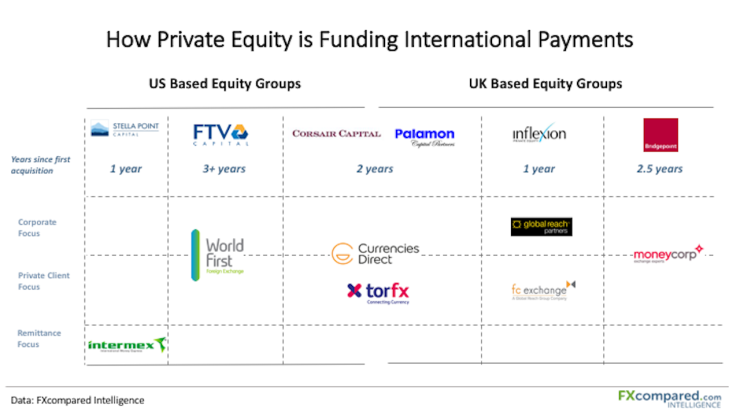

With focus often on the venture capital money flowing into the sector, it's easy to forget that Private Equity (PE) has been playing an increasingly prominent role in shaping the international payments sector too.

Our chart above takes a look at PE in the sector. We are clearly early in the current PE cycle of ownership - around two years on average. Typically, most PE groups hold positions for around 5-7 years. In the last cycle Apax held Travelex for a longer than average at 9 years (exited 2014), and OFX was held for between 4-7 years by different investors (exited 2013).

Whilst the focus of the first two investments of this cycle (Bridgepoint - Moneycorp and FTV Partners - World First) was to buy and back a single company, the newer PE entrants are pursuing a build and buy strategy adding scale in key geographic and customer segments. We can also expect some of the estimated $820bn of PE firepower on the sidelines to have an impact in the future as well.

Interestingly, only one firm, Stella Point Capital, has chosen to focus on the remittance side of international payments through their acquisition last year of Intermex, a company dedicated to money transfers in the US - Latin America corridor. Intermex itself was the result of a previous PE roll-up strategy.

The inevitable meeting of Private Equity and Venture Capital

As we’ve covered in previous letters, venture capital funding has primarily focused on the lower-value end of the market, assuming that technology and lower costs can more easily disrupt the behaviours of the average consumer than the harder to reach business customer. Though there has been investment into B2B international payments companies by venture firms, the opportunity to change business behavior is currently a higher barrier to hurdle but one beginning to be tackled, which leads us to:

- Consolidation in the sector being driven by PE money. As more independent companies are purchased, having scale in the sector will be of greater importance to fight off both rising competition and regulation. Note Euronet’s aggressive pursuit of Moneygram here too.

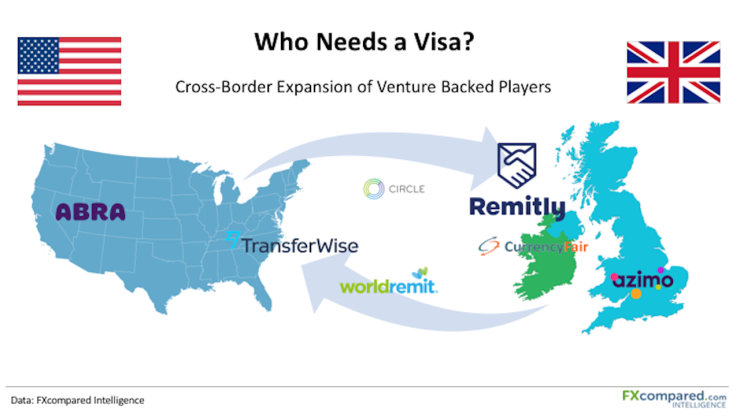

- The funding for the leading players such as Transferwise (c.$120m to date), WorldRemit(c.$150m) and Remitly (c.$100m) matching and potentially even overtaking the fire-power of the Private Equity players. Whilst most of the companies covered above have had the luxury to focus on specific market positions to date, they are beginning to have to go after the same customers in the same markets e.g. Transferwise targeting businesses or Remitly entering the UK.

Remitly (Quietly) Crosses the Pond

Seattle based international payment company, Remitly, has just begun offering transfers from the United Kingdom. We are used to seeing UK based companies come to the States, but American companies crossing over to the UK has in recent years been less common in this space.

Regulations and the required marketing budgets in the consumer international payments industry are notoriously challenging and require a serious investment of time and money. Raising over $100m appears to be the common yardstick for each of the companies below who have made the jump. Expensive VISAs!

Remitly launched in the US with a very focused, successful strategy of targeting just one corridor (US to the Philippines). It then expanded to India and Mexico and now offers 10 corridors. In the UK, we expect Remitly to follow the same strategy. It is starting with just two corridors - India and Philippines - with China appearing to be next on it's list.