Contents of the Report

- Report Summary

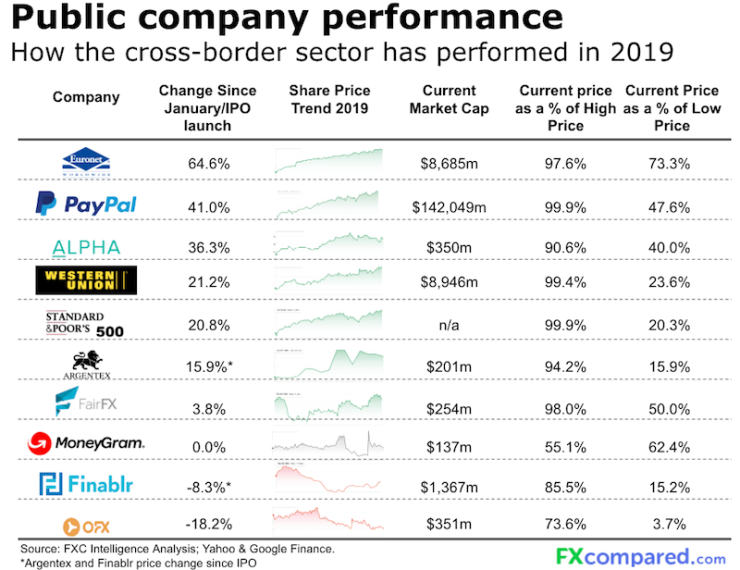

- Stock Market Performance of the Leading Money Transfer Players

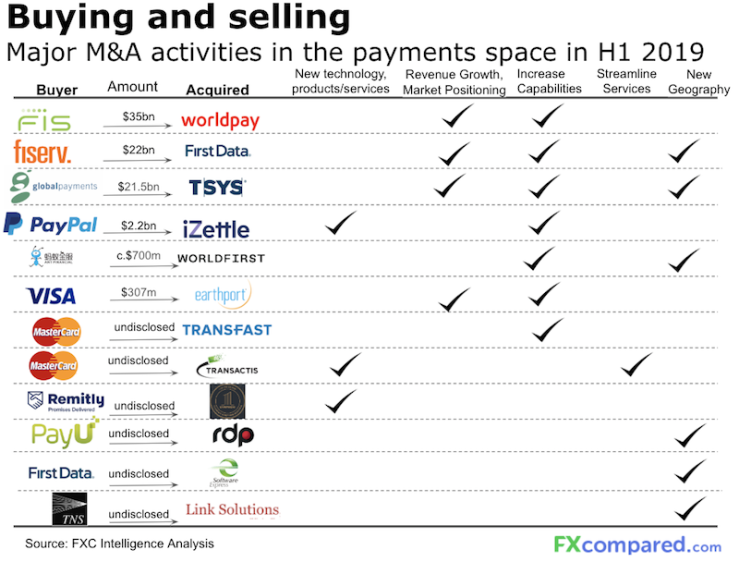

- Cross-Border Payments M&A Trends

- Fintech Fundraising in the Money Transfer Market

- TransferWise Pricing

- PayPal Push in Cross-Border Payments

- US neobanks and their money transfer offerings

- Blockchain developments in international payments

- Cross-Border Payments Market Update

- Money Transfer Industry Forecasts 2019-2024

1. Summary of the Money Transfer Report

2019 has been a fascinating year for the money transfer industry to date. If we look at the performances of some of the biggest players out there, Euronet who own Ria and PayPal in particular have seen strong growth in their share prices. Western Union had shown around share price 20% growth before its latest Q2 earnings announced it would be cutting 10% of its workforce. There were some new IPOs in the sector as both Argentex and Finablr, the owner of UAE Exchange and Travelex came to the market in the middle of the year.

For cross-border payments players such MoneyGram, it's been up and down, more recently up given the recent investment of blockchain service provider Ripple. And for OFX, some of the year has been slightly more challenging.

for $35 billion; Fiserv acquiring First Data for $22 billion; and Global Payments acquiring TSYS for $21.5 billion. There were some other deals in the space that are notable. PayPal completed its acquisition of iZettle and Ant Financial acquired payments company WorldFirst, who most recently have made some price changes and are already beginning to develop their business with their new owners.

FIS acquired WorldPay for $35 billion; Fiserv acquiring First Data for $22 billion; and Global Payments acquiring TSYS for $21.5 billion. There were some other deals in the space that are notable. PayPal completed its acquisition of iZettle and Ant Financial acquired payments company WorldFirst, who most recently have made some price changes and are already beginning to develop their business with their new owners.

Visa and MasterCard have been active in the money transfer space in 2019. Visa and MasterCard both fought over Earthport through the turn of the year. Visa ended up buying Earthport for just over $300 million to help expand its non-card reach for B2B and bank to bank account cross-border payments. MasterCard bought Transfast, who it had already been working with to help build out similar capabilities.

In the fintech scene, there have been some notable fund raisings in 2019. TransferWise, N26, Remitly, WorldRemit all saw big rounds raised.

TransferWise is maturing as a company and preparing for its next steps. N26, the neobank, has just entered the US market. Monzo, another neobank, also raised funds to allow it to enter the US market. Remitly and WorldRemit, two of the leading remittance focused players both took additional funds in. Remitly to focus more on new products, expanding into new markets and add to its working capital. WorldRemit particularly to launch its small business product and also to fuel further expansion.

There was a new unicorn in the sector as well, as Airwallex raised $100 million to put its valuation at unicorn status. Airwallex is particularly strong coming out of the Chinese market, focusing on marketplaces and businesses and online sellers. TransferWise continues to have a strong year. Their growth continues to be around a 100% year on year. In terms of their pricing that appears to have stabilized and is no longer trending towards zero. PayPal is one of the strongest players in the space and a substantial part of its business comes from cross border payments. It continues to grow, and at the moment has over $100 billion of cross border annual flow. And by its latest reports has 286 million active users making it a formidable player in the payment space. As far as the neobanks go, they have been mostly focusing on raising additional funds to enter new markets. The most significant of which is the US.

Monzo and N26 have just entered the US market. Revolut is still waiting for its clearance. Within the US market, there have also been some interesting fund raises, banks such as Varo raised significant amounts of money. And there are some different ways the banking sector is operating out of the US. With groups such as The Bancorp providing a platform for banking. Or some of the larger players such as Goldman Sachs, who launched Marcus, BBVA and Simple or SoFi, with SoFi Money, who have all supported the launch of new digital-Frst banking products.

Blockchain continues to be a signifcant theme in the sector. The most noteworthy announcement came from Facebook when they announced the launch of their Libra blockchain project. Remittances and serving the under-banked were stated as key use cases.Libra would be a stablecoin and it's meant to be run by a 100 other major players around the world. The initial group, which had around 30 memebers, skewed towards Silicon Valley and some of the established companies.

We'll wait to see who else might join the Libra association We're also waiting more details on how Calibra, Facebook's wallet, would be able to work with Libra. Ripple had a strong 2019 to date, particularly with its $30m investment into MoneyGram. This initially pushed MoneyGram's share price up as well. And MoneyGram is already using Ripple's xRapid products. A number of other banks and payment companies continue to work on blockchain projects, particularly to help with instantaneous internal clearing: JP Morgan, Visa, Swift, Santander, to name a few.

2. Stock market performance of leading money transfer players

2019 has been a very mixed year for the main players in the sector. We saw two new IPOs (Finablr and Argentex) but there remain few cross-border focused players.

Ria's H1 2019 Performance

Ria is part of US public company Euronet. Euronet continued to have a very strong year, to date, in 2019. They're up nearly 65%. One of the key segments of the Euronet business is Ria, its money transfer business. It also owns XE, which is more focused on the higher end of the money transfer segment.

Ria continues to grow well, quarter on quarter. Ria also focuses on cash payouts, different to the XE business. Ria, according to its latest filings has 385,000 cash payout remittance locations now, putting it in the same league as Western Union and MoneyGram.

PayPal H1 2019 Performance

PayPal continued to have strong year, as well. The stock's up 41% over the first half of the year. Cross-border payments remained the major segment of its business, and it also has an extremely broad product offering. PayPal offers products across the full credit line, and to individuals, and businesses, and merchants, and is one of the most valuable payment companies in the world.

Alpha FX H1 2019 Performance

Alpha FX is one of the new players in the market. They focus on the medium end of businesses, offering both Spot FX services and hedging solutions to them. They are listed on the Alternative Investment Market (AIM) out of London, and again had a good start to 2019 with their stock price up over 36%, and their market capitalization around $350 million.

Alpha has continued to expand into international markets as well, as they seek to grow the size of their business. Last year, Alpha opened a Canadian office and further expansion is expected.

Western Union H1 2019 Performance

Western Union has slightly outperformed the Standard Poor's 500 benchmark and was up 21% in the first half of the year. Its H2 filings made some big announcements where it said it was going to cut around 10% of its workforce to move to increase profitability going forward.

Western Union Digital continues to perform strongly and is one of the bright sparks of the business. Western Union still has over 10,000 staff members, so it's one of the largest employers in the money transfer sector.

Argentex H1 2019 Performance

Argentex is a new player to the public markets in the cross-border payments space having IPOed in June 2019. Much like Alpha FX, it focuses on smaller and medium companies, again helping them with their spot payments and their forwards and hedging needs.

Argentex is one of the smaller companies in the set, valued at just over $200 million, and its share price, due to the size of the company, has shown some volatility since it debuted on the stock market.

FairFX (Equals Group) H1 2019 Performance

FairFX, now known as Equals Group, performed failry in the first half of 2019, with very small growth. FairFX has been developing its product set, having made several acquisitions, such as City Forex, in the space.

MoneyGram H1 2019 Performance

MoneyGram ended the first half of the year flat in terms of its stock market performance. The perid included some spikes, such as when Ripple, the blockchain company, announced the $30 million investment in the company with a potential additional $20 million to follow. The price of the investment was set above $4 and the share price of MoneyGram briefly got close to that and then it went back a little.

In the latest quarterly filings, MoneyGram released that it has been beginning to work with Ripple's xRapid XRP solution, to start sending payments faster to certain parts of the world and also potentially cheaper. We'll await to see how broad the usage of Ripple's product will be for MoneyGram.

MoneyGram was also able to restructure its debt in the first half of 2019, which was a significant milestone for the company. That, plus the equity infusion from Ripple, puts MoneyGram on a much sounder and stronger footing. It also has a growing digital segment, but because of the deferred prosecution arrangement (DPA) from 2018, it still has declining revenues in the business and we await to see at what point the revenues stabilize.

Finablr 2019 Performance

Finablr was a new player in the public markets in 2019. It IPO'd in May 2019 with a value of over a billion dollars. Finablr has a mix of businesses. It works both in the remittance area, primarily under the UAE Exchange and Travelex brands. It also has Xpress Money and its newly launched brand Unimoni as it pushes more to the digital area.

The take rate, or margins, of the remittance business of Finablr, are well below those of Western Union and MoneyGram. Finablr also owns a sizeable travel money business, which provides significant revenues but a smaller proportion of the profit for the business. The travel segment mostly comes from the Travelex brand of the business. The fastest growing area of Finablr's business is its B2B payment services. This is the most valuable part of Finablr's current offering.

OFX 2019 H1 Performance

OFX had a more challenging 2019 to date, with its share price declining through the year.

3. M&A Trends in Cross-Border Payments

If we look to the big M&A trends through the first half of 2019, there were three very large mergers. FIS acquired WorldPay for $35 billion. Fiserv, for $22 billion acquired First Data, and Global Payments for $21.5 billion, acquired TSYS.

These first three acquisitions were focusing on growing revenue, increasing capabilities and both vertical and horizontal integration. PayPal has also been very active in the acquisition space and closed its acquisition of iZettle in the period, adding some new technology and services to its business.

Chinese financial giant Ant Financial, part of e-commerce group Alibaba, acquired WorldFirst, the U.K. based payment company. WorldFirst had to close the U.S. arm of its business in early 2019 to enable the transaction to go through, a sign of the political situation between the U.S. and China, at the moment.

Visa has been aggressively increasing its presence in the cross-border payments space, outside of what it does in the card segment. It bought Earthport, which helps it to connect into many of the bank accounts of the major banks around the world, and will help in its B2B cross-border payments offering. Both Visa and Mastercard were initially fighting over Earthport from late 2018. Visa ended up with Earthport, and Mastercard purchased a similar player, Transfast, for which it hopes to obtain similar business goals of expanding its non-card, B2B, cross-border payments offering.

Remitly made a small acquisition, buying Symphoni, and there were some other smaller acquisitions in the space.

4. Fintech Money Transfer Fundraisings in 2019

The first half of 2019 has been a very active one in the market.

TransferWise’s Growth

TransferWise has led the pack. In 2019 it raised a further $292 million at a three and a half billion dollar valuation. The investor mix of TransferWise changed as it looked to begin to position itself either for an IPO or the next stage of development.

TransferWise is currently growing at around 100% year on year and we could certainly estimate that from its current money transfer flows of around 50 to $60 billion a year, it has a good chance to reach $100 billion per year of FX flow within the coming years. Where do we think this growth is going to come from? We would expect it to take more share in other geographical markets. The UK money transfer market has been the strongest market for international payments TransferWise, but there is plenty of room for growth in other developed markets as it sends money around the world, focusing on the expat customer segment.

TransferWise started as a consumer product. It has been building out its offering for businesses. At the moment, business product accounts for around one sixth of the total flows, but we expect this to continue to grow, most likely at a slower rate than the consumer products because of the need for intervention by humans (salespeople) to help businesses send payments and also through the on-boarding process.

We also expect to see TransferWise likely sign up some more white label deals in France, it has BPCE. It also powers the neobanks, N26 and Monzo. These banking deals take a long time to do, but we would expect more to come from TransferWise.

N26's push into the US market

N26, the Berlin based neobank has attracted around three and a half million customers in the four years since it started. Also, it matches TransferWise with a three and a half billion valuation with it recent fund raising, that makes N26 the most valuable bank in the neobank segment across Europe. The latest funding round added another $170 million as it pushes into the US market.

Remitly’s Product Development

Remitly, in its most recent round raised $220 million, and it looks to continue its growth and development, particularly into new products. Remitly was founded in Seattle in 2011 and took a different approach to how it grew, by focusing on the US to Philippines money transfer corridor, and then grew itself from there. It now has FX flows that track annually at around six billion dollars per year and it has around one million customers.

Of their $135 million of equity that has been raised, where do we expect it to be spent? The first part is likely on new financial services. As the CEO, Matt Oppenheimer of Remitly says (read our Remitly CEO Interview), remittances is a key pain point, but the customers also often struggle to obtain other financial products, particularly on the credit side, as these customers tend to lack a credit history and may not have a bank account. Trying to solve for this will be potentially part of Remitly's next step.

Part of the raise was also to deal with the continued working capital needs of Remitly. Remitly offers a near instant payment service, but to do that, funds need to be available in the recipient country so $85 million of the recent fundraise was for a credit line to help serve that.

WorldRemit’s push into international payments for business

WorldRemit raised $175 million in 2019. It was one of the biggest raises to date and putting it just shy of a unicorn valuation. If we look back at the history of WorldRemit, where they spent the money and raised the money, in 2014 they raised $14 million to push into new geographies and new products and services. In 2015, they raised $100 million and began to team up with mobile money wallets that operated in Africa, Asia and Latin America. In 2016 they raised a further $45 million to fuel the next phase of growth and expand their global network. In 2017 they raised another $40 million as they sought to have a target customer base of 10 million globally. This most recent raise in 2019 is to diversify their product offering and to help launch into the business space.

WorldRemit, currently has just under four million customers, which we estimate as approximately 2% of Western Union's customer count. Going back to WorldRemit’s announcement in 2017 when they targeted 10 million customers, they're currently running a little short of this run rate, but this new fundraise should help them get closer to that customer goal.

Other Fundraisings in the Money Transfer Sector

Of the other groups that have raised money, Starling Bank is now forecasting to break even in 2020, one of the slightly smaller neobanks out of the UK. Monzo, from its fundraise is targeting pushing into the US as well. Monzo's money transfer product is powered by TransferWise.

Payoneer continues to focus on marketplaces and freelancers. There is some expectation there may be another fund raise or capital event coming later in 2019 or in 2020. Airwallex, a fintech based out of Melbourne, that has a strong China focus with marketplaces and small businesses, achieved its unicorn valuation with its fundraise earlier this year. We would expect to see more growth coming from them.

5. TransferWise raises prices

TransferWise since its launch has consistently been one of the lower cost offerings in the remittance sector. As the company has expanded its corridor coverage and focused on speed, its average costs of a transfer have also gone up as per its Quarter 2 report for 2019.

This data above is an average hiding many ups and downs for TransferWise as each currency corridor is positioned differently. See our detailed review of TransferWise too.

6. PayPal's cross-border growth continues

PayPal released its Q2 results recently and the topline numbers continue to look strong for cross-border although the share of cross-border volume relative to all of PayPal's payment volumes remain in decline.

This decline has been driven by a strengthening U.S. dollar, a reduction in eBay marketplaces volume and relatively stronger growth in PayPal's Braintree and Venmo product lines.

Key numbers from the earnings release:

- PayPal added a net 41 million new users over the past 12 months moving it to 286 million active user accounts in total.

- Venmo’s push continues with 70% growth in total payment volume to $24 billion.

- We've also previously covered Xoom's expansion to 32 new send markets throughout Europe.

Q3 revenue forecasts were cut hitting PayPal's stock price by c.6% overnight, although year to date PayPal's stock has performed very strongly up 44% in 2019. And clearly it remains a formidable cross-border competitor. Our PayPal comparison to Revolut, the leading neobank also sheds light on some of the key PayPal offerings.

7. US neobanks and their money transfer offerings

Some of the best funded neobanks, Monzo, Revolut and N26 are all planning to dominate the US market. In the first half of 2019, both Monzo and N26 launched their products in the US markets.

The US market has a much more fragmented banking system than the European markets these banks come from and since the Great Recession, there have been hardly any new banking licenses issued in the US. Chase, Citibank, Wells Fargo and Bank of America are the big four players who dominate the US market but they still hold less than 50% market share. The rest of the market comprises thousands of regional and local banks, all of which the neobanks hope to take share from.

It has not been all easy for new digital banks in the US. Finn, a digital bank launched by JP Morgan chase did not survive. Varo, an independent player just raised $100m but it is not clear if this is sufficient funding to take on the incumbents.

Both Monzo and N26 are powered by TransferWise. This gives a them a ready made product with which to attack the market. Revolut, with its own subscription fee based model for pricing, is expected to enter the US market but has not done so yet. It remains to be seen how much these new banking players will use their international money transfer offerings - very competitive compared to the banks in the market - to acquire customers.

8. Blockchain developments in international payments

One of the most significant announcements in this sector in 2019 was Facebook announcing the launch of its crypto currency Libra. The BBC was one of the first groups to break this story. Instantly Bitcoin saw a spike in its value as credence would return to crypto currency having a strong use case.

Facebook sits unique in the technology sector globally, given its reach of billions of users, c.2.4 billion users. This is well above even Gmail with one and a half billion users, or Alipay with around a billion users. Below that you have a jump down to Amazon and PayPal, both with around 300 million users. This puts Facebook in a significant and unique position to be able to launch such a project. Facebook also has around 7 million advertisers and about 90 million small businesses that operate on its platform. Its reach is actually unparalleled across the technology sector globally.

Looking at some of the positives from Facebook announcing its Libra project, it was applauded for taking a more partnership decentralized approach rather than the whole project being run by Facebook. There is meant to be 100 companies that'll be part of its membership of the Libra Association. Initially the members included big payment processors such as Visa and MasterCard, but there were no banks or money transfer companies initially on the list.

Libra is also backed by fiat currency, so unlike many other crypto projects, there is a hard currency behind it. This is expected to work like a weighted currency similar to the Singapore Dollar. It's hoped this will make the Libra more stable, but it is not clear yet how that may operate. And currency crises do still happen, even within currency arrangements which are stable.

Libra's meant to target several billion of the world's population who are under-banked, who have difficulty accessing financial services and in particular remittances. Libra will be launched alongside Calibra, which would be Facebook's wallet. It's unclear at this point exactly how Facebook and Calibra would interact.

There are also many questions around Facebook's Libra project. First, is there a market need for Libra? Facebook has had multiple previous attempts at different services for money transfer, particularly through its messaging project, that have not been particularly successful. We don't know if there is a clear link yet between operating social media platforms and transferring money.

There also has not been any crypto currency yet that has created enough use cases to make it widely used. It would be hoped that Libra would increase speed or reduce cost, particularly for something like money transfers. Although at the moment there are already a number of fintechs that have been particularly effective, InstaReM, TransferWise and Revolut, to name a few that already have very low cost and fast money transfers, so it is unclear whether this still needs to be solved.

Libra had stated that remittances was a significant part of its use case. 80% of remittances still operate with cash, so whether Libra is going to directly solve for the remaining 20% is a possibly, but the 80% of transfers needing cash does not appear to be solved by crypto currency. There was some criticism whether the initial founding membership mentioned was diverse enough, particularly that it was skewed to San Francisco venture-type firms and that the association would be based out of Switzerland, which would not make the US particularly happy.

There also remain open questions how some of the other big tech giants such as Apple, Google and Amazon would respond to Facebook trying to control the world's crypto currency, and it is unclear yet what their response might be. For now it appears that the US government and with its strong approach to financial regulation does not appear to be giving Facebook or Libra an easy path. Even if we look at some of the current major sites such as Coinbase, it is still actually quite expensive to transfer crypto to non-crypto currencies because of the costs of on-ramping and off-ramping of currency between fiat and non-fiat.

There continue to be other key players operating in the blockchain space outside of Facebook. Ripple is the most well known at the moment with it's MoneyGram investment, which it hopes will bring traction to its xRapid product.

The other core use case being worked on at the moment is internal clearing within a bank. Groups such as JP Morgan, HSBC, Santander and Signature Bank have all been working on blockchain related products where they're able to speed up and keep internal the currency clearing within their banks.

Visa is one of the major players in the payment space. It also continues to work on distributed ledger technology, although it has not announced any coin at this stage. And Swift, who is under fire from Ripple, but is owned by a cooperative of the banks, is also working on distributed ledger technology to augment it's Swift Gpi payments product.

We still are in the early days of how blockchain is going to impact the international payment space, and we will continue to see over the next five years what impact it has and what use cases are developed.

9. Money Transfer Market Update

dLocal continues expansion

dLocal focuses on the Latin American market and other emerging markets have continued to enter new markets, the latest ones being Indonesia, Ecuador and Bolivia. dLocal is successful at greatly increasing the acceptance rate of payments made, compared to some of the traditional processes and that's allowed it to build its business.

Rakuten to enter US banking market

Rakuten, the Japanese e-commerce conglomerate has decided to enter the US banking market. Without doubt, the US banking market is one of the most challenging markets to enter, with many thousands of banks, but we expect it to take a technology led and customer focused perspective, similar to how the neobanks have been approaching the product and the market.

Revolut hires a new CFO

Revolut has had a mixed year to date, but it has been re-positioning itself a little after some mixed press and has been hiring some new board members including a new CFO, David MacLean from UK challenger bank Metro Bank.

Ripple appeals to congress

Ripple, the blockchain company has been appealing to Congress so that some of the backlash from Facebook's Libra announcement does not impact all of cryptocurrency and blockchain and in particular, Ripple. Ripple has had a good recent few months, including its investment into MoneyGram, who are now using its xRapid product as well.

Amex agrees forex payout

American Express, who had been under a Department of Justice investigation was able to agree a payout and a refund to customers of $1.6 million. It also made some stark changes and we expect some process changes.

Cross-border wallet startups

Bank-backed cross-border wallet Payconiq raises EUR20 million

MoneyGram's Korean push

MoneyGram has continued its international push. It partnered with South Korean startup, Sentbe, and in the latest quarter earnings report from MoneyGram, it highlights Sentbe as a group helping to really try drive volumes in South Korea.

TransferWise beefs up its board

TransferWise has also been strengthening its board and it added the Adyen CFO and former Netflix CFO to its board. Following the recent fundraises of TransferWise, we expect them to continue to mature as a company.

Xoom officially launches in Europe

PayPal's Xoom pushes into 32 markets across Europe

Curve raises $55m

Data privacy concerns aside, another consolidator app pushes on

Varo raises $100m

The US neobank also refiles its FDIC application

Bank of England Governor on Libra

Some rare positive signals on the project and helping the unbanked

10. Money Transfer Industry Forecasts 2019-2024

If we look to our forecast for the next five years to 2024, we can highlight some interesting trends:

- We would expect PayPal and Euronet to continue to perform strongly as two of the leaders in this space. Both Western Union and MoneyGram are currently executing turnarounds, Western Union the most recently announced, so we would expect them both to look like slightly different businesses in five years and to have increased the digital share of their business.

- In terms of M&A trends, we would expect further consolidation to continue in the sector. At the top end, particularly with the payment processes, there may be further deals with some of the money transfer providers and including at the smaller end of the market. Some money transfer companies are still private equity owned, which will have to exit, and others are venture capital owned and at some point we'd expect to see IPOs.

- Fundraising in the sector for the more established groups, we would again continue to expect to see more funds raised and some even larger nine figure rounds as players look to win even more share from the incumbents. By 2024 some of the names on our fundraising chart below may well have exited, most likely via IPO.

- TransferWise by 2024 may well have significantly larger FX flows than Western Union, particularly if it continues at its current growth rates.

- PayPal we've seen continuing to develop its breadth of products, as well as some of the depth, and it should be an even more formidable player in the cross-border space in five years time.

- By 2024, a number of the neobanks will have established footholds in the US market. Some potentially will be acquired by larger US players. Others may not make it.

- Blockchain by 2024 may well have wider adoption. It'll be unclear if Facebook's Libra will still have arrived by 2024, depending how US Congress continues to treat it.

Without doubt, 2024 will look very different than 2019 in the money transfers sector.