FXC Intelligence: The industry standard for global payments data

The global payments market is enormous, constantly growing and full of opportunity for banks and financial services businesses. However, the sheer size of this market also makes it incredibly complex, meaning it can be difficult for those businesses to identify a clear path to profit.

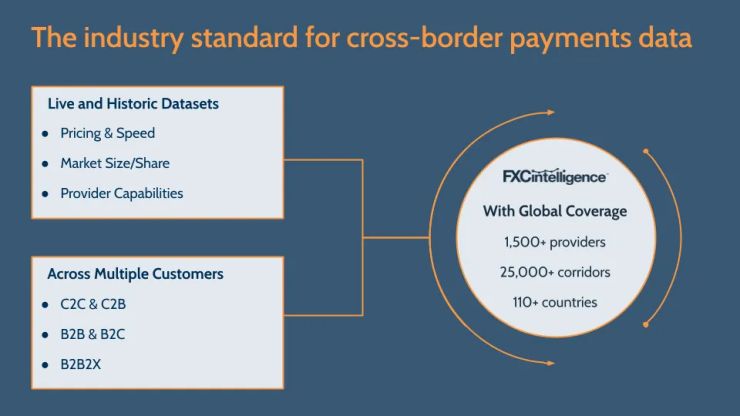

Banks and fintechs looking to enter new markets, adapt their pricing or launch new cross-border products need a firm grasp of the underlying data behind global payments. But with thousands of providers worldwide spanning tens of thousands of payment corridors, tracking how pricing and flows change across regions and competitors can be a daunting task to take on alone.

By providing accurate, timely data, FXC Intelligence helps global payments businesses to navigate this complex industry, understand their competitors and take action to boost their bottom line. Since 2015, we’ve been building the world’s most comprehensive FX pricing dataset specifically focused on global payments, spanning more than 25,000 corridors, 1,500 providers and 110 countries. Some of the world’s biggest financial institutions use our data to streamline decision-making, develop new strategies and, ultimately, boost profitability.

Find out more about what FXC Intelligence’s data can do for you below, or head to fxcintel.com.

What can FXC Intelligence’s data do for me?

Through our APIs or unique online portal, banks and companies can track price fluctuations in real time, benchmark against peers and gain competitive insights into a constantly changing market. Whether you are looking to enter a new market, change your pricing or introduce a new product, our data gives you the foundations on which to build the most profitable strategy.

Aside from FX pricing, our data covers global market sizing for cross-border payments; payment cards; ecommerce; and the developing crypto space. We track all the companies in the international payment, ecommerce and card industry sectors, from banks to payment companies to marketplaces and corporates, with new data being continuously added every hour of every day.

Who does FXC Intelligence serve?

With our standard datasets or bespoke solutions, we serve clients across a number of industries, including:

- Banks

- International payment companies

- Corporates

- Financial investment firms

- Governments and regulators

- Consultancies

Just some of our industry-leading clients are included in the graphic below.

Why should I trust FXC Intelligence’s data?

Our quality assurance teams track, review and validate data to continuously ensure it meets the highest standards. Not only that, our team of industry experts, analysts and reporters – led by a CEO with 20+ years of experience in the global payments industry – strive continuously to achieve the highest level of data quality possible.

Want to find out how FXC Intelligence’s data has helped transform for some of the world’s biggest payment businesses? Click here.

The world’s leading newsletter on global payments

Using our own data as well as extensive research, FXC Intelligence publishes the world’s leading newsletter on the global payments space, with new deep-dive reports, analysis, market maps, comment from industry experts and insights every single week.

You can find our extensive database of research pieces here, or sign up to our newsletter for free here.