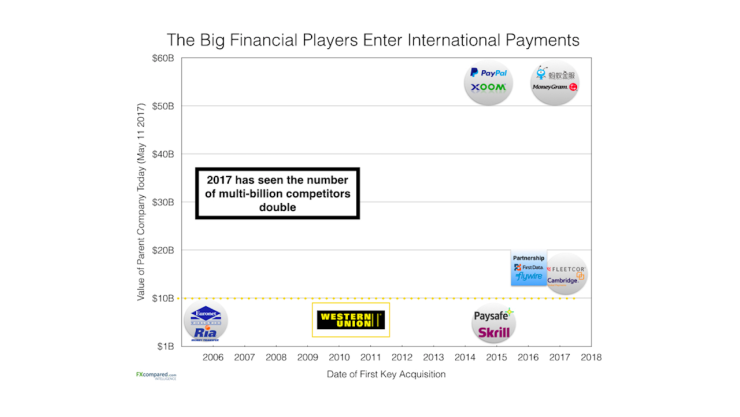

Last week FLEETCOR announced their purchase of Cambridge Global Payments. This news was shortly followed by an announcement that Flywire (formerly peerTransfer) and First Data have entered a major strategic partnership. As technology and globalization expand in tandem, international payments is attracting much larger companies to enter the space.

For a long time, Western Union (now worth $10bn) stood alone atop the sector. As of 2017, there are now four other companies worth more than Western Union who have made a major play in the sector. Without doubt, this is going to change the competitive landscape going forward.

CEO to CEO

Our CEO Daniel Webber recently spoke with Mark Smith-Halvorsen, CEO of Global Reach Partners. One of the most notable discussions we had revolved around the complex relationship between banks and payments companies.

Daniel: If you look five, maybe ten years forward - how do you see the sector within the UK changing? What are the banks going to be doing and what will Global Reach be doing?

Mark Smith-Halvorsen: I think in the last five years, I’ve seen the relationship with banks and independent FX brokers really change and morph into kind of solid state. The banks see us and treat us as aggregators now, so they’re missing out on the front end profitability of what we do, but they also are choosing not to carry the cost for the marketing, lead generation, KYC and technology elements of dealing with UK corporates.

Ironically what we then do, is package that up, average that transaction volume up, combine those payments and take them back to the ban. They’ve got used to quite sizeable incomes from us in terms of treasury and transaction fees. In a way, we’ve gotten very used to living with each other now and we understand what role each party plays in that.

You cannot operate a business like this unless you’ve got those really solid, valuable banking and treasury counterparties to underwrite the risks and facilitate payments. We are cohabiting nicely at the moment - I don’t expect that to change. But what I do expect is that the number of players and independent operators will shrink.

Read the extensive, exclusive interview here.