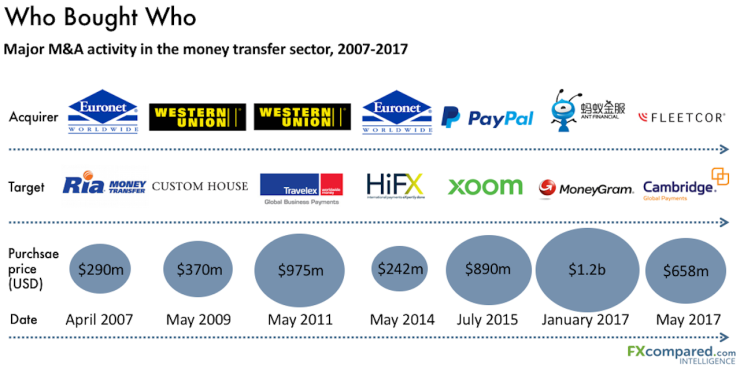

FLEETCOR enters International Payments Space with Acquisition of Cambridge Global Payments

FLEETCOR, a $13bn US public company specializing in fuel cards and employee payment products announced its purchase of Cambridge Global Payments for $900m CAD (c. US$650m) - one of the largest recent transactions in the space. A number of players from private equity to existing providers are known to have looked at Cambridge in what turned out to be a competitive auction. Cambridge, headquartered in Toronto, focuses on the B2B market and has an annual FX flow of $20bn CAD. Before yesterday's acquisition, it was one of the sector's largest independent players. In the end, Cambridge was bought by a company with no significant, previous international payments experience. The rationale for the transaction as laid out by FLEETCOR is to: Instantly add to FLEETCOR's bottom line (Cambridge is very much profitable) Provide an entry into the international payments market (FLEETCOR's current focus is U.S. fuel and payroll cards) Offer FLEETCOR's clients both domestic and now international AP products

The two most recently announced deals are notable in that both purchases have come from financial services companies with no specific international money transfer offering looking to enter the international payments market. Neither private equity (who have plenty of dry gun powder) nor the incumbents (who could benefit from synergies) have won the deals. Which takes us back to Moneygram...

Euronet Backs Down

Euronet released its first quarter 2017 results last week and CEO Mike Brown was open about the Moneygram situation. Some notable comments from Mike in his conference call covering the results: - "If you add up ourselves and Moneygram and Western Union, the three of them control less than 25% of the world's remittance. So, therefore, 75% is up for grabs and that's what we've been focusing on." This comes against a background of Euronet's money transfer business continuing to perform strongly (Ria, XE and HiFX growing by 12% year on year for Q1) - "This [the Moneygram acquisition] is a big one, this would have taken all our [dry gun] powder and then some. And if it doesn't go, then we've got a whole lot left...So we'll look for acquisitions and we have a few..."

P.S. Going after Moneygram hasn't been cheap. It has already cost Euronet $1.2 million.

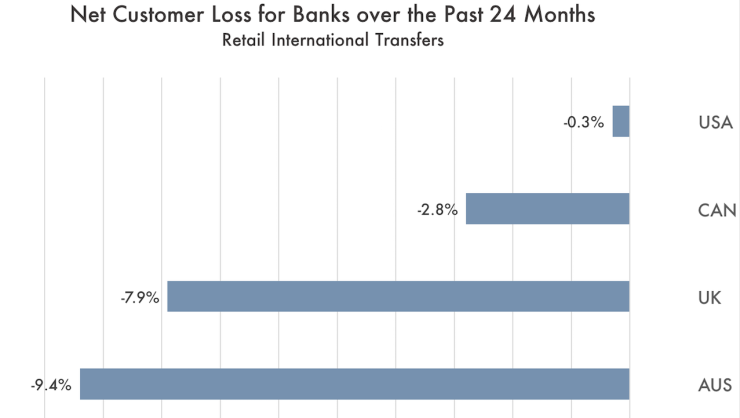

Are all customers ditching their bank?

As it turns out, it depends which country you're in. UK and Australian banks have really been feeling the pinch, but for US and Canadian banks, the story is not nearly as bad.

As we have shared in a previous letter, customers are not switching just because of price, but in the UK and Australia this is certainly the major factor.

Contact me to learn more about this data.