Transferwise: alone or on to something?

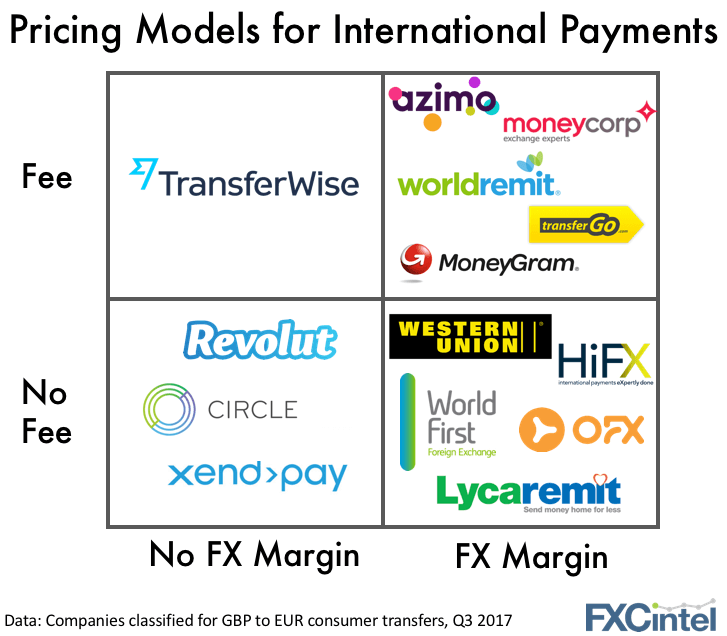

Money Transfer companies make money in primarily two ways: by adding a margin (sometimes small, sometimes large) on top of their wholesale FX rate, or charging a fee for each transfer. Or charging both. Or, apparently, none. Here's how a selection of leading non-bank providers currently make their money:

For those wondering, the companies listed as offering transfers with no fees and no additonal FX margin aren't running non-profit transfer services.

Groups such as OFX and HiFX are long-standing payments companies are have been tackling the price pressure in the consumer end of the market by cutting out their transaction fees. This strategy can be also be seen at companies such as World First as well.

Revolut is an alternative bank / travel money startup that subsidises transfers by issuing debit cards and collecting a percentage of the merchant transaction fees. Circle is a peer-to-peer payment app, backed by Barclays in the UK and Goldman Sachs in the US. Xendpay lets users pay what they want, but charges fees after customers transfer over £2,000 per year.

Will the MoneyGram buyout by Ant Financial get over the line?

We've been tracking this deal closely. After fending off a rival bid from Euronet and raising their offering price, Ant Financial may have run into a new hurdle in their quest to take over MoneyGram: the lengthy, opaque approval process of the Committee on Foreign Investment in the United States. According to Reuters, Ant Financial recently had to resubmit the deal for review, after failing to get approval on their first submission in the 75 day review window.

It's unclear if this reflects opposition to the deal or simply the slow nature of such committee reviews. Of course, the potential difficulty in gaining such approval was one of the main talking points Euronet used in their bid to derail Ant Financial's original offer. At the time, MoneyGram's board appeared unconcerned and ultimately voted to move ahead with Ant Financial's second, increased bid of $1.2bn. Western Union and Paypal have stayed quietly on the sidelines through out the process.

The fate of this deal is almost certainly being monitored by others in the industry as a sign to the potential hurdles facing foreign companies looking at US M&A deals. As the transfer industry begins to consolidate, such outcomes will be closely watched.