- Technology stalwarts like Amazon, Apple, Facebook and Google are the biggest threat to banking

- Banks need to invest in personalised customer marketing as well as upgrading their digital platforms to compete

-

The future of branch services hangs in the balance, but as broadband connections fail some rural inhabitants, they’ll be hoping for another solution

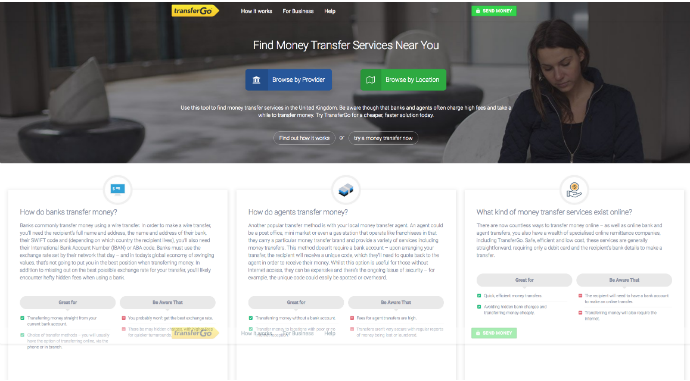

Customers will now have more choice and visibility of service providers, such as money transfer providers and insurance products. The biggest threat to banks competitiveness is not from fintech providers but tech giants such as Amazon, Apple, Facebook and Google. Banks not only need to invest in their digital capabilities and create some UX magic to keep hold of their customers, they also need to ensure that they give their customers a personal product and service offering. A Marketo report identified that 78% of consumers engage in promotions that have been personalised based on their previous interactions with that brand. Banks need to get under the skin of their customers’ behaviours. With all that data to hand they are in an enviable place to do so but they need to act quickly.

What is the prognosis for the bank branch and call centre in a truly digital world? Are they now close to being obsolete? In a recent PWC report, omni-digital customers represented 46% while those who relied solely on human interaction from branch visits, texts and call centres represented 10%. Arguably, from a KYC stand point, branches are useful for carrying out face to face verification, but this could be carried out through video networks, reducing the need to be manned. Furthermore as more people find out that they can carry out their banking services quicker through digital accounts, the demand on expensive call centres will be reduced. However, for those people living in rural locations, they’ll be hoping not. It is estimated that over 17% of rural homes still cannot access the broadband speeds required to have a stable connection, they not only fear being left behind, they’re also going to need somewhere that offers them the ability to bank.

The incidence of customers switching banks has always been low and current accounts have been loss leading for banks. They have made money by selling other financial products and services. As open banking drives competition, banks are going to have to work hard to keep up.