On Monday we sat down with Jonathan Quin, founder and CEO of World First, one of the fastest growing most profitable companies in the sector. We chatted about the state of international payments, why World First is moving away from FX options, and more. Here's part of our exchange:

FXcompared: You recently dropped options as a product line, what led you to do that?

J.Q.: "... We looked at it and it was using up a lot of time. It was using up half of our capital for 10% of our revenue and we felt that some of the regulations coming in were going to make that harder. It just didn’t fit with our goal of focusing on efficient, straight through processes and automated products.

...I wouldn’t be surprised if a lot of people follow suit, particularly as we get closer to the MIFID 2 launch and people reassess the capital requirements of those products under that environment."

____

In the rest of our extensive conversation with Jonathan, we cover the future of the payments industry, including his thoughts on:

- BlockChain, APIs, and the impact of other technologies

- Which regions present the most interesting opportunities

- Where banks will be in five years

- Future M&A Activity in the sector

- and much more...

Risk and Reward - the African Opportunity

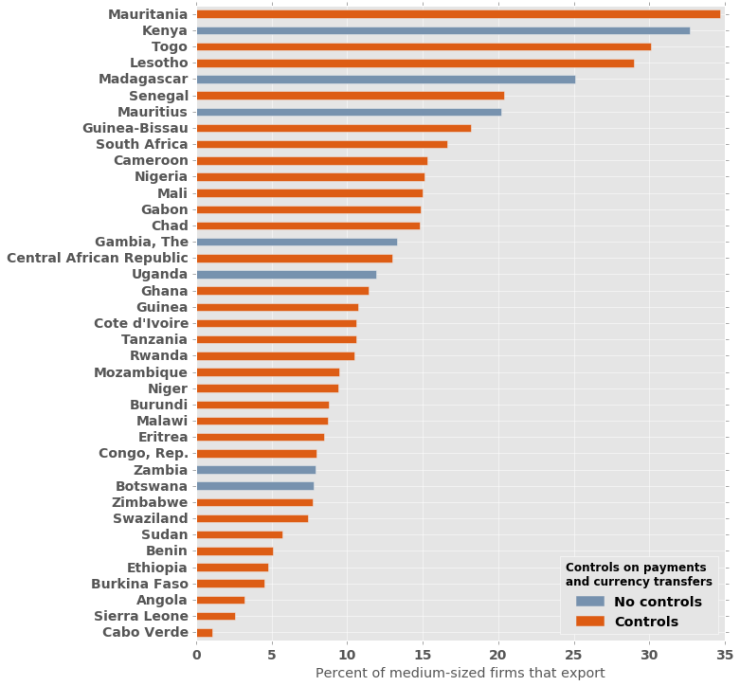

Sub-Saharan Africa is an often overlooked region among FX brokers and banks, largely due to the prevalence of currency controls and government restrictions. As part of our ongoing research into new market research opportunities, and in conjunction with our participation at the Georgetown Africa Business Conference (GTABC), we recently looked at the percent of medium-sized businesses in Sub-Saharan countries that export goods, along with the presence of currency controls.

Just seven of these countries are classified by the IMF as having no restrictions surrounding their payments or currency (represented above in blue). Still, there appears to be little evidence that the presence of controls has stopped countries from expanding their export operations - of the top five countries with the highest percentage of SME exporters, three have controls in place.

Our take: the prominence of international trade, currency risk, and lack of FX solutions in this region present an interesting opportunity for those willing to take on a challenging market.

The latest in international payments: Our favorite news and articles

Digital becomes physical. In response to the rise of mobile payments, retailers are being forced to rethink store layouts and how customers pay for goods. Salon.

Shrinking reserves. China's forex reserves fell below $3 trillion for the first time in five years, as China continues to intervene in the market to strengthen the Renminbi. Reserves peaked at $3.99 trillion in 2014. Financial Times.

A coming wave? AMobile payments haven't yet taken the world by storm, but Forrester research belives that's about to change. Barron's.

Want Insights Like These In Your Inbox?

Our weekly newsletter is packed with insights into the FX, international payments, and money transfer industry.