An Underserved Market?

Last week World First announced the launch of an international payments platform designed specifically for SMEs. The platform will give companies an alternative to (trying) to open multiple foreign currency accounts with one or more banks. World First likely recognizes the frustration many SMEs encounter when attempting to not only open foreign currency bank accounts, but the needs to hold and move this money. In markets such as the US, for example, many banks do not offer SMEs any options for multi-currency accounts.

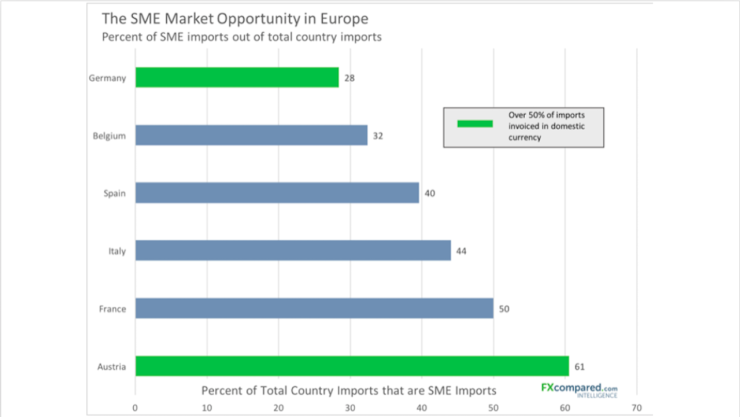

SMEs can be a hard to serve segment for traditional banks, as they can require a high touch service but may be small revenue generators. However, our own analysis highlights the values of SMEs in the traditional payments space. Across Europe, for example, a significant proportion of imports comes from SMEs and in the majority of cases, this is often in a foreign currency.

In addition to World First, Afex, Payoneer, Currencies Direct, Agility Forex and CambridgeFX are just a few of the nonbank international payment companies around the world that offer multi-currency accounts, all to varying degrees of sophistication compared to the World First product.

The Remittance Market Boosts Fintech in South Korea

Our intelligence group likes to keep tabs on growing markets in the sector. Recently, the burgeoning fintech scene in South Korea has caught our eye. Ant Financial has also noticed South Korea. In February of 2017, Ant Financial invested $200 million into South Korean company Kakao, a $5 billion firm that runs the dominant messaging service in South Korea, used on 95% of mobile phones. The investment is to help the growth of KakaoPay, the fintech arm of Kakao messaging service. Given Ant Financial's desire to expand payments platform Alipay globally, their investment in South Korea's fintech scene is of little surprise. In March of this year, PayPal invested in South Korea based Viva Republica and their financial services platform, Toss, part of a $48 million round.

South Korea's population is over 50 million and over 41 million people in South Korea use mobile phones, making South Korea a fertile ground for fintech startups. In a testament to the growth of Seoul's fintech scene, last week a South Korean agency announced the South Korean government's plans to ease equity capital requirements for fintech companies that provide foreign currency services. This decision could be a major coup for remittance focused fintech companies in South Korea, particularly for the bitcoin focused, such as Korbit, Sentbe or Blocko.