In this report we look at some of the major drivers of overseas property purchases

A strong pound has been driving Brit’s ability to invest in property outside of the UK

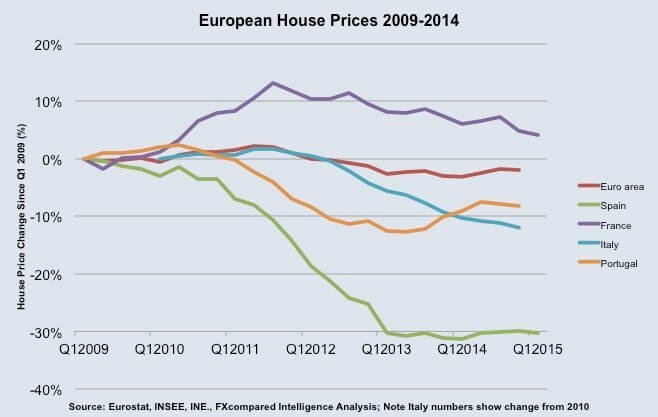

Property prices in certain European countries such as Spain remains depressed providing further investment opportunities

Contents

- Summary

- Currency a key determinant of overseas purchases

- Overseas property as an investment

- The political and policy context

- Outlook

- See this report as an Infographic

Summary

- Sterling strength, a key driver of interest in buying overseas, has become even more important. Nearly half (46%) of property investors are keen to take advantage of the strong pound to buy property abroad.

- The combination of a strong pound and subdued property prices in Europe has made buying abroad even more affordable.

- Overseas property bought for personal use is concentrated in Europe, while overseas property bought for investment is more spread out geographically.

- Political and policy risk has subsided following the May general election, supporting interest in overseas buying.

- With the prospect of more property being bought overseas, more money will be sent abroad from the UK.

Currency a key determinant of overseas purchases

Nearly half (46%) of UK based property investors are keen to take advantage of the strong pound to buy property abroad according to our own independent research of investors conducted in mid-May, 2015. Indeed, currency and exchange rates were either the main factor (16%) or had some influence on the decision (34%) to make an investment in half of all cases, with overseas money transfer likely to pick up as a result. A strong pound was the most cited factor in driving purchases abroad in the past six months, having strengthened by around 25% against the euro since the end of 2008, and around 9% since the start of the 2015, touching an eight-year high in March. Uncertainty within the eurozone has supported the pound at these levels, with expectations of sterling strength becoming an even more important driver of respondents’ plans to buy overseas, especially given that euro countries such as France, Spain, and Portugal being the most popular destinations for UK buyers.

In Spain, particularly popular among retirees, property prices in the first quarter of 2015 were still 30% lower than six years earlier, meaning that a property going for €500,000 in 2009 would cost only £250,000 now compared to around £480,000 at the time. In France, prices for existing properties have been falling since 2011, but are still around 4% higher than they were at the start of 2009, reducing the savings from a weaker euro. That said, a property going for €500,000 in 2009 would still be some £100,000 cheaper at around £375,000 now. In Portugal, the prices today for a €500,000 property in 2009 would be around £330,000 today. As for Italy, where data start in 2010, a property going for €500,000 at the time would now set back British buyers around £315,000, down from £440,000 then. It is unsurprising, then, that a clear majority (65%) of respondents who believed that the best opportunities for property investment over the past 12-18 months lay overseas, cited these four countries.

Overseas property as an investment

The picture is a little less clear with regards to buying for investment rather than personal buying. Unsurprisingly, the UK is the most popular country for the purchase of investment property. Personal use properties overseas tend to be bought in Europe given ease of access from the UK. In contrast, overseas property investments are much more geographically spread out, with UK investors owning in the US, Canada, Eastern Europe, and Asia, for example. As such, while the economic outlook, and thus that of the business and residential lettings market, in mainland Europe remains subdued, economic prospects in the US and Asia are improving much faster. Overseas investment potential remains a key driver of overseas purchases, with 23% of respondents citing it as a factor over the next 12-18 months. That the economic outlook across diverse geographies is so varied, however, perhaps explains why this was down from 28% in the previous six months.

While the strong pound makes purchases more affordable, it will, however, reduce the value of any Income received in euros. Most private owners of holiday home tend to them out primarily to cover costs rather than necessarily derive income, so the issue of converting this income back is less important given that the majority of running costs such as utilities and local taxes will be in euros. Owners may also want to keep money in a local currency for when they themselves use the property on holiday. In the cases where property is bought specifically as an investment rental, and/or if any mortgage on the property - if taken out in the UK - is not covered by other income, then measures to protect against currency fluctuations when sending money internationally become much more important.

The political and policy context

Political uncertainty and potential impact of UK General Election was the third most cited factor for buyers having looked abroad over the past six months. Since the election, political uncertainty in the UK as a driver of future overseas purchases has become slightly less important. Several factors could account for this. First and foremost, simply the stability that comes with the government having secured an outright majority has been supportive of sterling. In contrast, a predicted hung parliament that would have necessitated drawn-out negotiations to form a coalition government would have weighed on the currency.

Notwithstanding uncertainty surrounding the referendum on the UK’s membership of the EU, there could also be positive aspects to a Conservative government specifically, such as belief in the party’s better economic management and thus prospects for the British economy and property prices. One key concern for property owners of a possible Labour government had been the possibility of the introduction of a “mansion tax”. With this no longer likely, prospective property buyers, whether domestic or overseas, may not have to worry so much about a rise in property costs, especially after the change in stamp duty in October 2014, freeing up money for new acquisitions.The most frequent ranges of property portfolio sizes of those surveyed was £150-300,000, £301-750,000, and £750,000-£1.5m. Together these bands accounted for 75% of all respondents, with an average value of £570,000. The slight savings of up to nearly £5,000 from reduced stamp duty for properties up to £937,500, made buying in the UK slightly less expensive. But for those with more expensive properties, particularly above £1.5m where the changes in stamp duty have been felt - some 14% of respondents said they had a portfolio of this size or more - the rise in stamp duty costs may have boosted the appeal of buying overseas instead of the UK. Eleven percent of respondents added to their overseas property portfolio in the past six months.

Outlook

Sources:

- FXcompared Intelligence commissioned survey by Atomik Research in May 2015. 510 property investors were surveyed - 55% male and 45% female.

- Eurostat, INSEE, INE

Infographic