Fees are an integral part of the international transfer industry, for both banks and non-bank providers. The exactly manner in which such fees are assessed however, varies widely between organizations. Some banks charge different fees depending on the transfer corridor, while others impose a flat fee regardless of the transfer size or destination.

To help providers and customers better understand this area of the market, we recently took a look at the major banks and FX brokers operating in the UK and how their fee structures compare.

Here's how it all shakes out.

Election Fears

In case you missed it, the U.S. presidential election is exactly one week away and everyone here at FXcompared is pretty excited to have less politics in their news-feeds (especially our New York team). However, major elections also tend to produce currency fluctuations - especially when there's an upset.

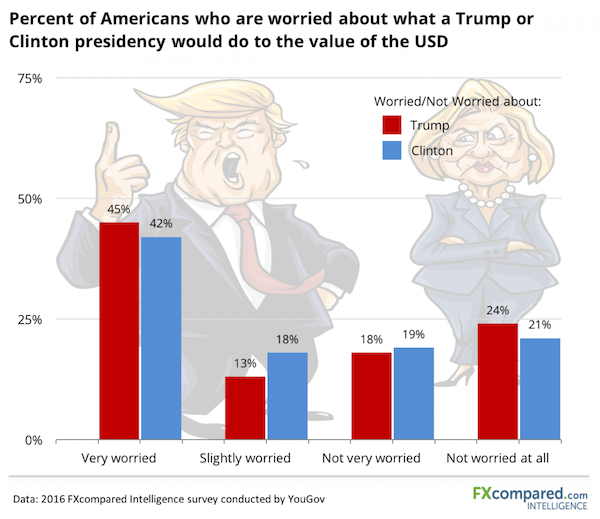

In a recent survey of U.S. consumers, we asked people their thoughts on the upcoming election, and how they thought the outcome might affect the strength of the U.S. dollar.

Money 20/20 Closing Bell

Last week our Founder Daniel Webber was at Money20/20 and one of the big focuses was the use and adoption of BlockChain-based networks. Here are my three takeaways from panels, meetings, and (some very) informal conversations:

1. International payments will not be the first widely adopted use case for BlockChain. Smart contracts and record management are much more likely.

2. The technology still lacks the consistent standards needed to allow for mainstream roll-out/adoption.

3. BlockChain is definitely going to be part of the financial industry, just nobody quite knows which part yet. And much like in Vegas, people are putting down lots of bets.

Want Insights Like These In Your Inbox?

Our weekly newsletter is packed with insights into the FX, international payments, and money transfer industry.