Introduction

With borders for global capital increasingly blurring, new channels of money transfer are emerging thick and fast. The UK is one of the leaders in the fintech revolution, particularly in the money transfer sector, which is the focus of this report.

With consistent rise in internatinal money transfer and new, innovative services, only a minority of consumers now prefer banks ahead of any other modes of transfer. Online transfer services are a relatively recent entrant into the market, and they are fast overtaking banks as primary mechanisms in the money transfer market. Above the three to four figure remittances level, the specialist currency brokers are driving the banks out of the market.

Earlier this year, FXcompared Intelligence commissioned an independent online survey of 2,000 UK residents about their experiences, preferences and perspectives on international money transfer. The results underscored only a minority left with a preference for banks, and also uncovered insights on the UK market and the motivations of the UK consumer.

Of the 2,000 respondents to the survey, 26% of people surveyed said that they transferred money at least once annually in the UK in 2014. A majority of these people (69%) transferred small amounts of money (less than £500) infrequently and typically for purposes such as vacations.

Banks now serve a minority of the transfer channels

The consumer preference for non-banking options was also seen when the entire surveyed population was asked how they would view making a money transfer. When posed with a hypothetical money transfer situation, some preference for banks remained. Respondents who had not transferred money in the past also showed a preference for bank transfers.

(Hypothetical) Choice of Money Transfer Channels for £1,000, £10,000 and £100,000

| Mode of Money Transfer Preferred at various hypothetical amounts | £1,000 | £10,000 | £100,000 |

|---|---|---|---|

| Would not use a bank and would use a money transfer provider by phone | 7% | 8% | 8% |

| Would not use a bank and would use a money transfer provider online | 10% | 9% | 10% |

| Would use a bank no matter what | 47% | 42% | 45% |

| Would use a bank only if it gave me the best rate | 37% | 41% | 37% |

Source: FXcompared Intelligence

Money Transfer is a pre-meditated exercise

Money moves across borders for a variety of reasons. One-time transfers for travel and small purchases show different patterns from the activities of people who transfer medium and large-sized amounts overseas, typically for items such as property.

Our research confirms this: a sizeable majority (77%) of those who moved higher amounts (above £500) across borders did so multiple times a year.

Across all transfer sizes, 56% would make ad-hoc transfers, based purely on need, 31% said that they would wait for the best exchange price. This insight reveals that a significantly large segment of consumers who use money transfer services closely monitor exchange rates.

Who transferred what in 2014

| Money Transfer Split for 2014 | (%) |

|---|---|

| Transferred small amounts for travel money (less than £500) in 2014 | 18% |

| Did Not Transfer Money Internationally | 74% |

| Transferred £500 or more in 2014 | 8% |

| Total | 100% |

Source: FXcompared Intelligence

What matters to people making international transfers?

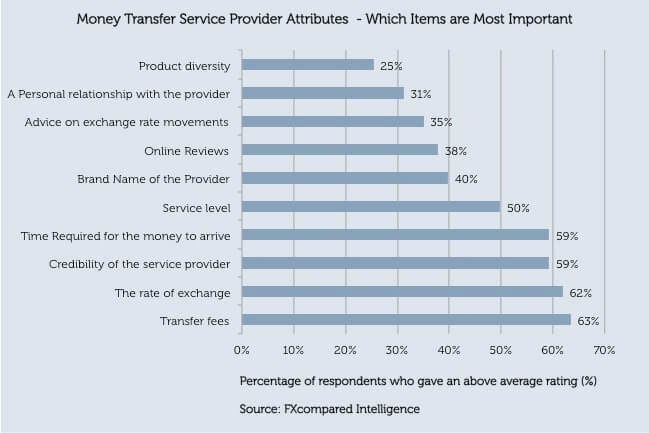

We asked respondents who transferred money overseas in the past what mattered the most to them when choosing the best mode for money transfer. This was based on a five point scale with a rating of four and five counting as an above average rating.

Transfer fees rated the highest among respondents with 63% rating it above average. The rate of exchange ranked second and 62% rated it above average. Credibility was also important with 59% rating it strongly. Finally, the time the transfer takes was also important and 59% rated it above average.

With a high focus on cost and exchange rate, other factors pertaining to financial services receded in focus. Brand name of the service provider was less important to people with only 40% rating it above average.

Advice on exchange rate movements too was lower on the list with only 35% rating it higher than average. A personal relationship was rated high by 31% of respondents. Diverse product offerings mattered most to 25% of respondents.

Older users have been slower to adapt

Another explanation of the some residual preference for banks may come from the different age segments of the money transfer market. Understandably, 35% of those who use banks for money transfer are aged over 55. In the same vein, 30% of those who said they used online transfer services were in the 25-34 age range.

Putting this another way, 53% of those who used banks were over the age of 45 and 65% of those who used online transfer services were below 45.

Consumer Preferences vs. Transfer Channels

Ranking consumer preferences against the money transfer channels they use mostly highlights what is most important to the consumer for each mode of transfer.

However, some consumer choices are counter intuitive. For instance, the presence of transfer fees was the highest rated concern of respondents who used banks for international money transfers. Similarly, speed of transfer rated third. Personal relationship ranked a low seventh amongst those who used banks. This means that many who readily use banks for international transfers desire service attributes that banks don’t provide or are paying for service attributes that they don’t consider a priority.

Ranking of Importance of Attributes for Different Types of Providers

| Mode of Money Transfer Used by Respondents | Percentage of Respondents | Exchange Rate | Transfer fees | Credibility | Brand Name | Personal Relationship | Online reviews | Product Diversity | Advice on Exchange Rates | Time Required to transfer | Service Level Offered |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Banks | 42% | 5 | 1 | 4 | 6 | 7 | 9 | 10 | 8 | 3 | 2 |

| Online-only Money Transfer Provider | 28% | 5 | 4 | 9 | 10 | 8 | 1 | 2 | 3 | 6 | 7 |

| Money Transfer Broker | 13% | 9 | 10 | 7 | 4 | 1 | 5 | 2 | 3 | 8 | 6 |

| Storefront Service Provider | 13% | 7 | 10 | 4 | 1 | 6 | 3 | 2 | 5 | 9 | 8 |

| Other | 4% | - | - | - | - | - | - | - | - | - | - |

Source: FXcompared Intelligence

Conclusion

The disruption of the UK international money transfer sector is now firmly under way. In a sector that was once dominated by banks and Western Union, there are now two other significant groups of players – the currency brokers (such as World First, Moneycorp, TorFX, UKForex and Currencies Direct) and the online Peer2Peer players (such as Transferwise, WorldRemit and CurrencyFair). A sizeable proportion of the UK population still trusts their banks and the question remains how many of these consumers the new players can win over.

Survey Methodology

The survey was collected from a representative sample of 2,000 UK adults by OnePoll between the 3rd and 18th February 2015. OnePoll are members of ESOMAR and employ members of the MRS. For further data or information on this report, please contact us a research@fxcompared.com