Headquartered in New York, Travelex first opened for business in 1976 in London, offering foreign exchange currency services to retail customers. Today, Travelex is one of the leading independent foreign exchange, money transfer, and international payment service providers, delivering financial services to 37 million retail and corporate clients through its 1,500 stores and 1,250 ATMs in 28 countries. Travelex also offers cash and prepaid cards to customers looking for foreign currency travel solutions or an easy way to make purchases while on the go.

Offer help to negative reviews posted on Trustpilot

Active social media presence on platforms including Twitter and Facebook

1,100 ATMs in both on-airport and off-airport locations

Price Promise – If you find a cheaper overall price elsewhere, Travelex will refund the difference

Travelex Money Card grants access to free Wi-Fi and offers no added charges on cash withdrawals

Calculator available to estimate travel money

Customer bonuses including discounted National Theatre tickets

Collection available in just 4 hours

Details must be inputted manually for each transaction

Unreliable mobile app

Lack of transferable locations in Africa and Asia

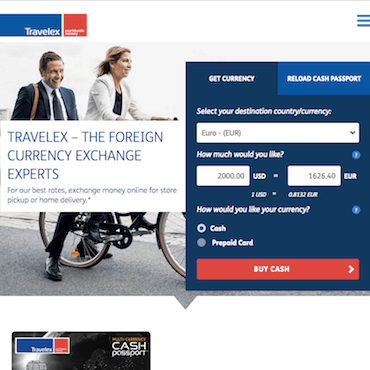

Travelex makes it easy to acquire foreign currency, send money abroad, or make payments through its secure online system, and provides access to the best foreign currency exchange rates, forex currency specialists, and numerous locations across the globe. The company specializes in helping retail customers find currency through its 1,500 stores and 1,250 ATMs in 28 countries. Individuals can pre-order currency online, over the phone with a Travelex currency specialist, or in person.

The Travelex money service and international payment services give individuals the ability to send money at a low, flat fee or completely fee-free, depending on the amount of money being sent. Customers can make one-time or recurring payments through Travelex and can also purchase forward contracts to lock in favorable exchange rates. Customers have access to Travelex foreign exchange specialists 24 hours a day, five days a week.

Customers can purchase the Travelex prepaid currency card (the Multi-Currency Cash Passport™ Prepaid MasterCard®), which gives them access to up to five different currencies at the same time, on the same card. This allows customers to travel to multiple countries without the need to obtain currency in each location, and also helps customers to lock in a favorable exchange rate and avoid fluctuating rates. The card also comes with the Travelex emergency service, available 24/7 to card holders.

Currently, Travelex currency card holders planning to travel outside the United States can pre-pay for euros, British pounds, Japanese yen, Canadian dollars, and Australian dollars.

Travelex provides a range of foreign exchange transfer and international payment services to businesses and enterprises, and maintains a number of strategic relationships with financial institutions, retailers, travel agents, and airport operators to offer business customers a variety of foreign exchange services. The Travelex currency services include more than 1,500 North American financial institutions, a stock of more than 80 foreign currencies, and a global network that enables the company to move currency quickly when needed.

Travelex provides its business customers with a range of foreign exchange services to make obtaining or sending currency simple and convenient. Its CashPaxTM and Cash PassportTM services allow customers to simplify currency transactions in a timely manner. Its CashPaxTM service is a pre-packaged grouping of currency, including a range of banknotes and coins, while the Cash PassportTM is a pre-paid currency card that allows customers to make purchases on the go. Both services are offered in euros, British pounds, Canadian dollars, Japanese yen, and Australian dollars. The CashPaxTM is also offered in Mexican pesos.

Originally opened in London, Travelex is now based in New York, where it provides its foreign exchange currency services and bill payment solutions to over 37 million individual and business customers worldwide. The company delivers its services through its 1,500 stores and 1,250 ATMs in 28 countries. Travelex also offers pre-packaged cash and prepaid cards in a number of currencies.

Travelex has partnerships with Western Union and OzForex, and sources and distributes FX banknotes for a number of central banks and financial institutions around the world. In 2013, the company reached over 10 million Travelex ATM transactions.

Great exchange rates | Specialist services | No added fees, 24/7 transfers | Safe and secure

OFX (previously UKForex in the UK), provides secure and speedy international money transfers to over 300,000 people in 55 currencies at better-than-bank rates

Excellent exchange rates | No transfer fees | Thousands of 5 star reviews

Great rates | One-off payments | Regular transfers | E-Money Institution | No fees for FXcompared customers

Currency exchange specialists ranking No.1 on Trustpilot for the past two years

One-off payments | Regular payments | Great rates | Safeguarded customer funds

Banks are the most expensive way to do an international money transfer, the quotes from the providers above show you the typical savings that can be made. All providers on FXcompared.com are regulated in the UK by the FCA, in the USA by FinCEN, In Canada SSC and Australia, ASIC.

We check all rates regularly and this quote is an actual quote of the average from UK banks for this month. It includes all major and small banks. Lloyds, Barclays, HSBC, Santander, NatWest, RBS, Coutts, Handelsbanken, Metro bank and more - tracked every month. We obtain our rates via our IMTI platform.

Shop with PayPal and you’ll still earn your points, airmiles and cashback. Fees are shown as part of the overall exchange rate.

FXcompared.com is an fx money comparison site for international money transfer and to compare rates from currency brokers for sending money abroad. The website and the information provided is for informational purposes only and does not constitute an offer, solicitation or advice on any financial service or transaction. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. FXC Group Ltd and FX Compared Ltd does not provide any guarantees of any data from third parties listed on this website. FX compared Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from (i) any error, omission or inaccuracy in any such information or (ii) any action resulting therefrom.