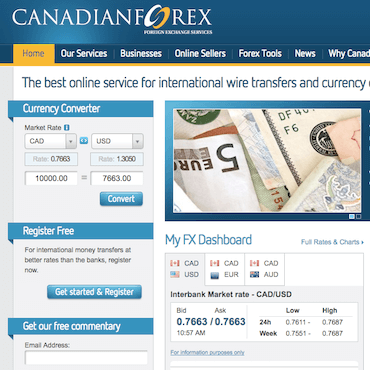

CanadianForex was launched in 2007 and is a wholly-owned subsidiary of the OzForex Group, one of the world’s leading international payments and online foreign exchange services. CanadianForex offers favorable currency exchange rates and secure money transfer and payment services at low fees to corporate and individual clients and is FinTRAC regulated.

CanadianForex offers secure money transfers with some of the best money transfer rates, as well as the ability to make recurring fx international payments, to their individual customers. CanadianForex customers can choose between three methods to send money abroad: the Basic Money Transfer, a forward contract, or a limit order. The Basic Money Transfer is a spot option, which is a transfer that is executed immediately using the best exchange rate that the CanadianForex currency specialist can find. Once the specialist has found the best rate, they will execute the transaction for the customer.

If the customer has found a favorable exchange rate but does not need to send money immediately, they can purchase a forward contract, which gives the customer the ability to lock in the favorable rate but use it at a future date. Forward contracts are a great way to protect the customer from fluctuations in exchange rates. Limit orders are another way that customers can preserve their money if they are concerned about rate fluctuations. Often used for large money orders or when the customer does not have to send money immediately, a limit order allows the customer to specify the exchange rate they want. The CanadianForex currency specialist will only execute the transfer when the rate reaches the range the customer specified.

Recurring transfers are a way for CanadianForex customers to make money transfers or international payments on a regular, ongoing basis. Recurring transfers allow the customer to set up an automatic payment plan, saving them time and money on their international money transactions. Recurring payment plans are a great option for customers who need to make regular international payments for a loan or debt pay-off, for a mortgage payment or monthly rent payments, for paying tuition fees for children studying abroad, for a vendor payment, or any other recurring payment. Recurring transfer plans can be set up as fixed payments, for those customers who have a set amount that they need to pay on a regular basis (a mortgage payment, for example), or as a non-fixed payment, which is good for customers who need to send money overseas periodically, but in differing amounts. Non-fixed payments can be a good option for customers who are sending money to relatives living abroad where the amount may be different from payment to payment.

Non-fixed payment plans do not require a deposit. Fixed payment plans do require a deposit up-front when setting up the plan. The deposit is equal to the amount of one payment, and is due at the time the first payment will be made.

CanadianForex gives corporate clients the ability to make overseas money transfers and international payments, as well as providing forex risk management services, 24-hour access to the cutting edge technology systems pioneered under the OzForex Group, and superb customer service. CanadianForex assigns a dedicated FX market specialist to its business customers. This specialist will have a deep understanding of the foreign exchange marketplace and will work with the corporate client to manage their foreign exchange risk exposure.

CanadianForex also gives its business clients the ability to set up recurring transfers, allowing them to automate their international payment needs, including employee salary payments, subscription fees, vendor service payments, or any other type of regularly-occurring payment.

Launched in 2007, CanadianForex is a wholly-owned subsidiary of the OzForex Group, one of the world’s leading international payments and online foreign exchange services. The OzForex Group also includes UKForex, NZForex, and Tranzfers. The group has offices on six continents and employs approximately 200 employees. CanadianForex is registered in Canada with FINTRAC, the Financial Transactions and Reports Analysis Centre of Canada.

Excellent exchange rates | No transfer fees | Thousands of 5 star reviews

Great exchange rates | Specialist services | No added fees, 24/7 transfers | Safe and secure

OFX (previously UKForex in the UK), provides secure and speedy international money transfers to over 300,000 people in 55 currencies at better-than-bank rates

Great rates | One-off payments | Regular transfers | E-Money Institution | No fees for FXcompared customers

Currency exchange specialists ranking No.1 on Trustpilot for the past two years

Banks are the most expensive way to do an international money transfer, the quotes from the providers above show you the typical savings that can be made. All providers on FXcompared.com are regulated in the UK by the FCA, in the USA by FinCEN, In Canada SSC and Australia, ASIC.

We check all rates regularly and this quote is an actual quote of the average from UK banks for this month. It includes all major and small banks. Lloyds, Barclays, HSBC, Santander, NatWest, RBS, Coutts, Handelsbanken, Metro bank and more - tracked every month. We obtain our rates via our IMTI platform.

One-off payments | Regular payments | Great rates | Safeguarded customer funds

Shop with PayPal and you’ll still earn your points, airmiles and cashback. Fees are shown as part of the overall exchange rate.

FXcompared.com is an fx money comparison site for international money transfer and to compare rates from currency brokers for sending money abroad. The website and the information provided is for informational purposes only and does not constitute an offer, solicitation or advice on any financial service or transaction. None of the information presented is intended to form the basis for any investment decision, and no specific recommendations are intended. FXC Group Ltd and FX Compared Ltd does not provide any guarantees of any data from third parties listed on this website. FX compared Ltd expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from (i) any error, omission or inaccuracy in any such information or (ii) any action resulting therefrom.